Market Trends

Key Emerging Trends in the Amorphous Polyethylene Terephthalate Market

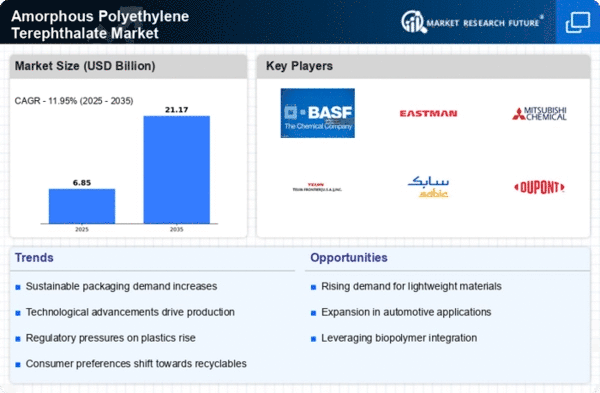

The Amorphous Polyethylene Terephthalate (APET) market is experiencing notable trends that are shaping its trajectory in recent times. APET, a thermoplastic polymer, finds extensive use in various industries, including packaging, electronics, and automotive, owing to its desirable properties such as transparency, chemical resistance, and recyclability. One prominent trend in the market is the increasing demand for sustainable packaging solutions. With growing environmental concerns, businesses and consumers alike are seeking eco-friendly alternatives to traditional packaging materials. APET, being recyclable and offering a reduced carbon footprint, has gained traction as a viable option for sustainable packaging, driving its market growth.

Another significant trend in the APET market is the rising popularity of lightweight materials in the automotive sector. As the automotive industry continues to focus on fuel efficiency and emission reduction, lightweight materials become crucial in achieving these goals. APET's lightweight nature, coupled with its durability and strength, positions it as a preferred choice for manufacturers in the automotive sector. The demand for APET in automotive applications is expected to witness substantial growth as the industry embraces the shift towards lighter and more sustainable materials.

Moreover, technological advancements and innovations in APET manufacturing processes contribute to the market trends. Manufacturers are investing in research and development to enhance the properties of APET, making it more versatile and adaptable to diverse applications. Improved processing technologies have resulted in enhanced thermal stability and mechanical properties of APET, expanding its potential applications across various industries. These advancements fuel the market growth by unlocking new possibilities and markets for APET products.

On the global scale, the APET market is witnessing geographical shifts in demand. Emerging economies, with their growing consumer bases and industrialization, are becoming key players in the APET market. As these regions experience increased urbanization and disposable incomes, the demand for packaged goods and electronics rises, subsequently boosting the demand for APET. Market players are strategically expanding their presence in these regions to capitalize on the evolving market dynamics and tap into new growth opportunities.

However, challenges such as fluctuating raw material prices and the availability of alternative materials pose threats to the steady growth of the APET market. The cost volatility of key raw materials used in APET production, such as purified terephthalic acid (PTA) and ethylene glycol (EG), can impact the overall production costs for manufacturers. Additionally, the development of alternative materials with similar or superior properties may divert demand away from APET, compelling market players to continually innovate and differentiate their products.

Leave a Comment