Market Analysis

In-depth Analysis of Amorphous Polyethylene Terephthalate Market Industry Landscape

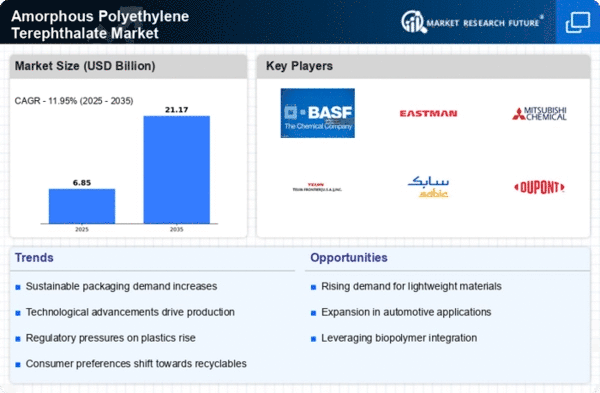

The market dynamics of Amorphous Polyethylene Terephthalate (APET) are influenced by a myriad of factors that collectively shape its trajectory. APET, a thermoplastic polymer, finds extensive use in various industries, including packaging, electronics, and automotive, owing to its remarkable properties such as transparency, chemical resistance, and recyclability. One of the key drivers propelling the APET market is the rising demand for sustainable and eco-friendly packaging solutions. As environmental consciousness grows, industries are increasingly opting for APET as it can be easily recycled and helps reduce carbon footprints.

Furthermore, the packaging industry's continuous evolution and the need for lightweight materials have spurred APET's adoption. Its versatility and ability to be molded into various shapes make it an ideal choice for packaging applications. The food and beverage sector, in particular, has witnessed a surge in the use of APET due to its suitability for food packaging, ensuring product safety and extending shelf life. Additionally, the electronics industry relies on APET for its insulating properties and durability, contributing to the market's growth.

However, the APET market is not immune to challenges. Fluctuations in raw material prices, particularly in the petrochemical industry, can impact the overall cost of APET production. Moreover, stringent regulations and standards regarding plastic usage and recycling practices can pose hurdles for market players. Companies operating in the APET market must continually innovate and align with sustainability goals to overcome these challenges.

Geographical factors also play a crucial role in shaping the market dynamics of APET. Developed regions with established packaging industries tend to be significant consumers of APET, while emerging economies witness a growing demand for the material as their industries expand. The Asia-Pacific region, in particular, has emerged as a key player in the APET market, driven by the rapid industrialization and urbanization in countries like China and India.

Technological advancements further contribute to the market dynamics of APET. Ongoing research and development efforts focus on enhancing the material's performance, reducing production costs, and exploring new applications. The advent of bio-based and recycled APET demonstrates the industry's commitment to sustainability, catering to the growing demand for environmentally friendly materials.

Competitive forces within the APET market are shaped by the presence of key players, each striving to gain a competitive edge through product innovation, strategic partnerships, and mergers and acquisitions. Market consolidation is a common trend as companies seek to strengthen their market positions and expand their product portfolios. This competition fosters innovation and ensures a dynamic landscape within the APET market.

Leave a Comment