Aging Population

The Global Ambient Assisted Living Market Industry is significantly driven by the increasing aging population worldwide. As of 2024, the global population aged 65 and older is projected to reach approximately 1.5 billion, highlighting a growing need for innovative solutions to support independent living. This demographic shift necessitates the development of technologies that can assist older adults in their daily activities while ensuring their safety and well-being. The demand for ambient assisted living solutions is expected to rise, as these technologies can enhance the quality of life for seniors, allowing them to age in place and maintain their autonomy.

Rising Healthcare Costs

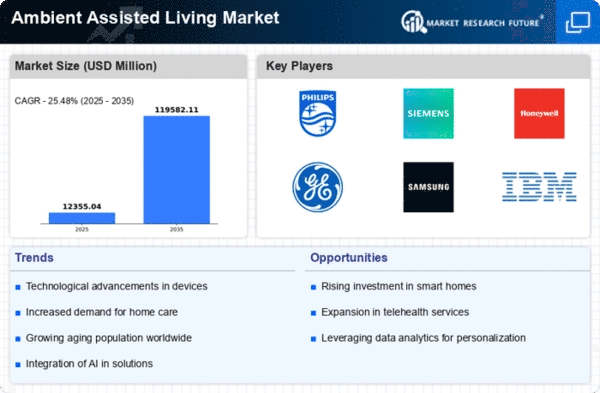

The escalating costs associated with traditional healthcare services are influencing the Global Ambient Assisted Living Market Industry. With healthcare expenditures rising globally, there is an increasing emphasis on cost-effective solutions that can reduce the burden on healthcare systems. Ambient assisted living technologies provide a viable alternative by enabling seniors to receive care in their homes, thereby minimizing hospital visits and institutional care costs. This shift not only alleviates financial pressure on families but also promotes a more sustainable healthcare model. As a result, the market is expected to witness a compound annual growth rate of 25.48% from 2025 to 2035, reflecting the growing preference for home-based care solutions.

Market Growth Projections

The Global Ambient Assisted Living Market Industry is poised for remarkable growth, with projections indicating a market size of 9.85 USD Billion in 2024. This growth trajectory is anticipated to continue, with estimates suggesting a substantial increase to 119.5 USD Billion by 2035. The compound annual growth rate during the period from 2025 to 2035 is expected to be 25.48%, underscoring the rising demand for innovative solutions that cater to the needs of an aging population. These figures reflect the increasing investment in research and development, as well as the growing recognition of the importance of ambient assisted living technologies in enhancing the quality of life for seniors.

Technological Advancements

Rapid advancements in technology are propelling the Global Ambient Assisted Living Market Industry forward. Innovations in smart home devices, wearable health monitors, and telehealth services are transforming how care is delivered to older adults. For instance, the integration of artificial intelligence and machine learning in ambient assisted living solutions enables personalized care and real-time monitoring of health conditions. These technologies not only improve the efficiency of care but also empower seniors to manage their health proactively. As the market evolves, the adoption of these advanced technologies is likely to drive substantial growth, with the industry projected to reach 119.5 USD Billion by 2035.

Consumer Awareness and Acceptance

Growing consumer awareness regarding the benefits of ambient assisted living technologies is shaping the Global Ambient Assisted Living Market Industry. As more individuals become informed about the advantages of these solutions, including improved safety, health monitoring, and enhanced quality of life, acceptance rates are rising. Educational campaigns and community outreach programs are playing a crucial role in disseminating information about available technologies. This heightened awareness is likely to drive demand, as families seek to implement these solutions for their elderly loved ones. Consequently, the market is expected to expand, reflecting the increasing recognition of the value of ambient assisted living in supporting aging populations.

Government Initiatives and Funding

Government initiatives aimed at promoting independent living for seniors are a key driver of the Global Ambient Assisted Living Market Industry. Various countries are implementing policies and funding programs to support the development and adoption of ambient assisted living technologies. For example, initiatives that provide financial incentives for the installation of smart home devices and assistive technologies are becoming increasingly common. These efforts not only enhance accessibility but also encourage innovation in the sector. As governments recognize the importance of supporting their aging populations, the market is likely to experience significant growth, aligning with the projected increase in demand for ambient assisted living solutions.