Growth in Construction Activities

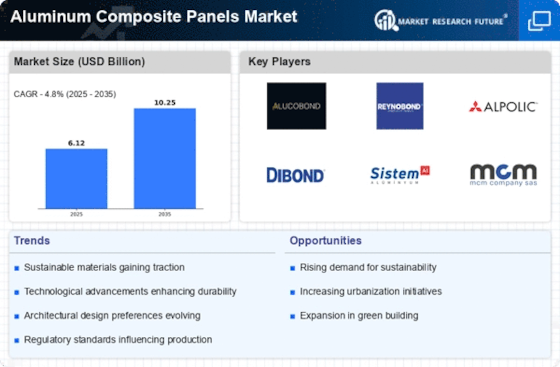

The Aluminum Composite Panels Market is poised for growth due to the ongoing expansion of construction activities worldwide. Urbanization and population growth are driving the need for new residential and commercial buildings, which in turn increases the demand for innovative building materials. The construction sector is expected to witness a compound annual growth rate of approximately 6% over the next few years. Aluminum composite panels are increasingly utilized for their aesthetic appeal and functional benefits, such as insulation and weather resistance. This growth in construction activities is likely to create substantial opportunities for manufacturers and suppliers within the Aluminum Composite Panels Market.

Increased Focus on Aesthetic Appeal

Aesthetic considerations are becoming increasingly important in the Aluminum Composite Panels Market, as architects and designers seek materials that enhance the visual appeal of buildings. Aluminum composite panels offer a wide range of colors, finishes, and textures, making them a popular choice for modern architectural designs. This trend is particularly evident in commercial buildings, where the exterior appearance can significantly impact brand perception. The market for decorative aluminum composite panels is projected to grow at a rate of 7% annually, indicating a strong preference for visually appealing materials. As the demand for unique and attractive building facades rises, the Aluminum Composite Panels Market is likely to see a corresponding increase in product offerings.

Rising Demand for Lightweight Materials

The Aluminum Composite Panels Market is experiencing a notable increase in demand for lightweight materials across various sectors, particularly in construction and transportation. This trend is driven by the need for energy efficiency and reduced transportation costs. Aluminum composite panels, known for their lightweight yet durable properties, are increasingly favored in building facades and interior applications. According to recent data, the construction sector is projected to grow at a rate of 5.5% annually, further propelling the demand for aluminum composite panels. As industries seek to optimize performance while minimizing weight, the Aluminum Composite Panels Market is likely to benefit significantly from this shift towards lightweight solutions.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of aluminum composite panels are playing a crucial role in shaping the Aluminum Composite Panels Market. Innovations such as improved coating techniques and enhanced bonding methods are leading to higher quality products with better durability and performance. These advancements not only improve the lifespan of the panels but also reduce production costs, making them more accessible to a wider range of consumers. The introduction of automated manufacturing processes is expected to increase efficiency and reduce lead times, further driving the growth of the Aluminum Composite Panels Market. As technology continues to evolve, manufacturers are likely to invest in research and development to stay competitive.

Regulatory Support for Sustainable Building Practices

The Aluminum Composite Panels Market is benefiting from regulatory support aimed at promoting sustainable building practices. Governments are increasingly implementing policies that encourage the use of eco-friendly materials in construction. Aluminum composite panels, which can be recycled and have a lower environmental impact compared to traditional materials, align well with these regulations. The market is expected to see a rise in demand as builders and developers seek to comply with sustainability standards. Recent data indicates that the green building materials market is projected to grow at a rate of 10% annually, suggesting a favorable environment for the Aluminum Composite Panels Market as it adapts to these regulatory changes.