Growing Energy Sector

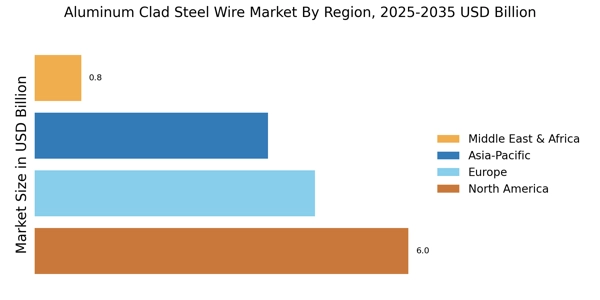

The growing energy sector is a pivotal driver for the Aluminum Clad Steel Wire Market. With the increasing demand for energy and the transition towards renewable sources, the need for efficient transmission and distribution systems is paramount. Aluminum clad steel wire is particularly advantageous in this context due to its lightweight nature and excellent conductivity, making it ideal for overhead power lines and renewable energy applications. In 2023, investments in renewable energy infrastructure were estimated at over 1 trillion USD, highlighting the sector's expansion. As energy companies seek to enhance their infrastructure, the Aluminum Clad Steel Wire Market is likely to experience heightened demand. This trend suggests a promising outlook for the industry as it aligns with the global shift towards sustainable energy solutions.

Technological Innovations

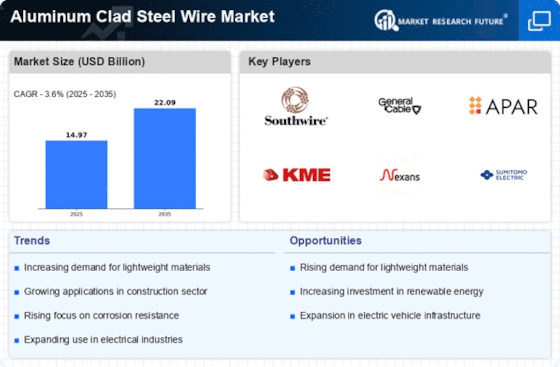

Technological advancements play a crucial role in shaping the Aluminum Clad Steel Wire Market. Innovations in manufacturing processes, such as improved cladding techniques and enhanced alloy compositions, are likely to enhance product performance and durability. These advancements not only improve the mechanical properties of aluminum clad steel wire but also reduce production costs, making it a more attractive option for various applications. The integration of automation and smart technologies in production lines is expected to streamline operations, further driving efficiency. As of 2023, the market has seen a compound annual growth rate (CAGR) of around 5%, reflecting the positive impact of these technological innovations on market dynamics. The Aluminum Clad Steel Wire Market is thus positioned to benefit from ongoing research and development efforts.

Infrastructure Development

Infrastructure development remains a key driver for the Aluminum Clad Steel Wire Market. As nations invest in upgrading and expanding their infrastructure, the demand for durable and efficient materials is likely to increase. Aluminum clad steel wire, known for its strength and resistance to environmental factors, is well-suited for applications in bridges, power lines, and other critical infrastructure projects. In recent years, significant investments in infrastructure have been reported, with expenditures reaching approximately 3 trillion USD in 2023. This trend is expected to continue, as governments prioritize infrastructure as a means to stimulate economic growth. Consequently, the Aluminum Clad Steel Wire Market stands to benefit from these ongoing developments, as the need for reliable materials becomes increasingly paramount.

Sustainability Initiatives

The Aluminum Clad Steel Wire Market is experiencing a notable shift towards sustainability initiatives. As industries increasingly prioritize eco-friendly practices, the demand for aluminum clad steel wire, which offers enhanced recyclability and reduced environmental impact, is likely to rise. This material's ability to combine the strength of steel with the lightweight properties of aluminum aligns with the growing emphasis on sustainable construction and manufacturing processes. Furthermore, regulatory frameworks promoting the use of sustainable materials may further bolster market growth. In 2023, the market for aluminum clad steel wire was valued at approximately 1.2 billion USD, indicating a robust interest in sustainable alternatives. As companies strive to meet environmental standards, the Aluminum Clad Steel Wire Market is poised for expansion.

Diverse Industrial Applications

The Aluminum Clad Steel Wire Market is characterized by its diverse range of applications across multiple sectors. From telecommunications to automotive and construction, the versatility of aluminum clad steel wire makes it an essential component in various products. In telecommunications, for instance, its lightweight and corrosion-resistant properties are highly valued for overhead lines and cables. The automotive sector also increasingly utilizes aluminum clad steel wire for its strength-to-weight ratio, contributing to fuel efficiency. As industries continue to explore new applications, the demand for aluminum clad steel wire is expected to grow. In 2023, the market was projected to reach 1.5 billion USD, driven by the expanding use of this material in innovative applications. This trend underscores the Aluminum Clad Steel Wire Market's adaptability and potential for future growth.