Growing Emphasis on Data Quality

In the Alternative Data Market, there is a growing emphasis on data quality and reliability. As organizations increasingly rely on alternative data for critical business decisions, the integrity of this data becomes paramount. Companies are investing in data validation and cleansing processes to ensure that the information they utilize is accurate and trustworthy. This focus on data quality is reflected in the increasing demand for data providers that can guarantee high standards of data integrity. The market for data quality solutions is expected to grow significantly, potentially reaching 5 billion dollars by 2025. This trend underscores the importance of reliable alternative data in driving effective decision-making and fostering trust among stakeholders.

Integration of Advanced Analytics

The integration of advanced analytics within the Alternative Data Market is transforming how organizations interpret and utilize data. Companies are increasingly adopting sophisticated analytical tools to extract actionable insights from alternative data sources. This trend is underscored by the growing investment in analytics technologies, which is expected to exceed 200 billion dollars by 2025. As organizations seek to enhance their data-driven decision-making capabilities, the demand for alternative data that can be seamlessly integrated with analytics platforms is likely to rise. This integration not only improves the accuracy of predictions but also enables businesses to uncover hidden patterns and trends, thereby fostering innovation and strategic growth.

Expansion of Investment Strategies

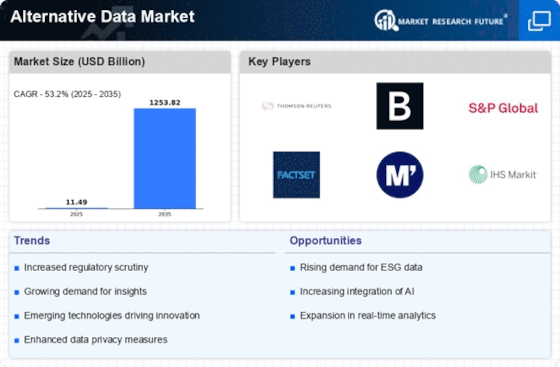

The Alternative Data Market is witnessing an expansion of investment strategies as institutional investors and hedge funds increasingly incorporate alternative data into their decision-making processes. This shift is driven by the recognition that traditional data sources may not provide a comprehensive view of market dynamics. As a result, alternative data is becoming a critical component of investment strategies, with a projected market growth rate of over 30% annually. Investors are utilizing alternative data to identify emerging trends, assess risks, and optimize portfolio performance. This trend indicates a broader acceptance of alternative data as a legitimate tool for enhancing investment outcomes, thereby reshaping the landscape of financial analysis.

Rising Demand for Real-Time Insights

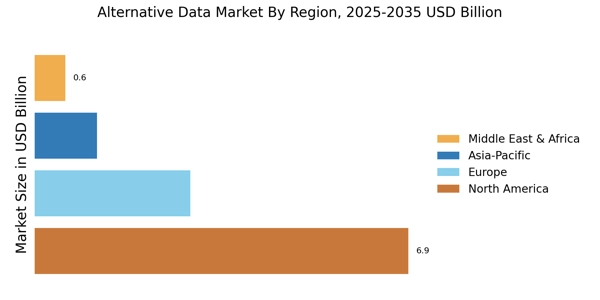

The Alternative Data Market is experiencing a notable surge in demand for real-time insights. As businesses increasingly rely on timely data to make informed decisions, the need for alternative data sources that provide immediate information has become paramount. This trend is particularly evident in sectors such as finance and retail, where companies are leveraging alternative data to gain competitive advantages. According to recent estimates, the market for alternative data is projected to reach approximately 10 billion dollars by 2026, driven by the necessity for rapid decision-making. The ability to access and analyze data in real-time allows organizations to respond swiftly to market changes, thereby enhancing their operational efficiency and strategic positioning.

Regulatory Developments and Compliance

The Alternative Data Market is navigating a complex landscape of regulatory developments and compliance requirements. As the use of alternative data becomes more prevalent, regulators are scrutinizing data practices to ensure consumer protection and data privacy. Organizations are compelled to adapt to these evolving regulations, which may include stricter guidelines on data sourcing and usage. This regulatory environment is likely to drive demand for compliance solutions within the alternative data sector, as companies seek to mitigate risks associated with non-compliance. The market for compliance technologies is projected to grow, reflecting the increasing importance of adhering to legal standards while leveraging alternative data for competitive advantage.