Technological Innovations

Technological advancements play a crucial role in shaping the Alpha Olefin Sulfonate Market. Innovations in production processes, such as the development of more efficient synthesis methods, have led to cost reductions and improved product quality. These advancements enable manufacturers to meet the rising demand for high-performance surfactants across various sectors, including agriculture and industrial cleaning. Market analysis suggests that the introduction of new formulations and applications could potentially increase the market size by 10% over the next five years. As technology continues to evolve, the Alpha Olefin Sulfonate Market is likely to witness enhanced competitiveness and product diversity.

Sustainability Initiatives

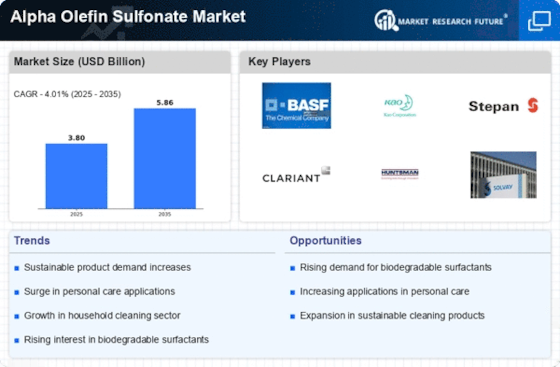

The increasing emphasis on sustainability is a pivotal driver for the Alpha Olefin Sulfonate Market. As consumers and manufacturers alike prioritize eco-friendly products, the demand for biodegradable surfactants has surged. Alpha olefin sulfonates, known for their environmental compatibility, are gaining traction in various applications, including personal care and household cleaning products. This shift towards sustainable practices is reflected in market data, indicating a projected growth rate of approximately 5% annually in the coming years. Companies are investing in research and development to enhance the sustainability profile of their products, which further propels the Alpha Olefin Sulfonate Market.

Expanding Industrial Applications

The industrial sector is increasingly adopting alpha olefin sulfonates, which is a significant driver for the Alpha Olefin Sulfonate Market. These surfactants are utilized in various applications, including oilfield chemicals, textile processing, and metal cleaning. The versatility of alpha olefin sulfonates allows them to perform effectively in diverse industrial environments, leading to a projected market growth of approximately 6% in this segment over the next few years. As industries continue to seek efficient and effective cleaning agents, the Alpha Olefin Sulfonate Market is poised to benefit from this expanding demand.

Rising Demand in Personal Care Products

The personal care sector is experiencing a notable increase in the demand for alpha olefin sulfonates, significantly impacting the Alpha Olefin Sulfonate Market. These surfactants are favored for their mildness and effectiveness in formulations such as shampoos, body washes, and facial cleansers. Market data indicates that the personal care segment accounts for nearly 30% of the total demand for alpha olefin sulfonates, with projections suggesting continued growth as consumers seek high-quality, gentle products. This trend underscores the importance of the Alpha Olefin Sulfonate Market in catering to evolving consumer preferences and enhancing product offerings.

Regulatory Support for Eco-Friendly Products

Regulatory frameworks increasingly favor eco-friendly products, which serves as a catalyst for the Alpha Olefin Sulfonate Market. Governments worldwide are implementing stricter regulations on the use of harmful chemicals, prompting manufacturers to shift towards safer alternatives like alpha olefin sulfonates. This regulatory support not only enhances the market's growth potential but also encourages innovation in product development. Industry expert's suggest that compliance with these regulations could lead to a 7% increase in market share for eco-friendly surfactants over the next few years. Consequently, the Alpha Olefin Sulfonate Market is likely to thrive as it aligns with regulatory trends.