Sustainability Initiatives

The Alkaline Water Electrolysis Market is increasingly aligned with sustainability initiatives that aim to reduce environmental impact. As consumers and businesses alike prioritize eco-friendly practices, the demand for sustainable water solutions is growing. Alkaline water electrolysis presents a viable alternative to traditional bottled water, which often contributes to plastic waste. By utilizing electrolysis technology, companies can produce alkaline water on-site, thereby minimizing transportation emissions and packaging waste. Furthermore, the energy used in electrolysis can be sourced from renewable resources, further enhancing its sustainability profile. This alignment with environmental goals is likely to attract a broader customer base, thereby fostering growth within the Alkaline Water Electrolysis Market.

Rising Health Consciousness

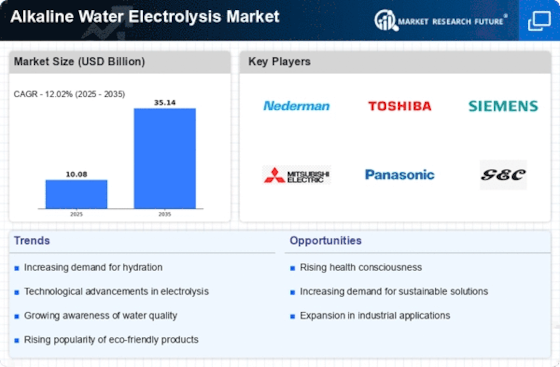

The Alkaline Water Electrolysis Market is significantly influenced by the increasing health consciousness among consumers. As individuals become more aware of the benefits of alkaline water, such as improved hydration and potential detoxification properties, the demand for alkaline water products is on the rise. Market data indicates that the consumption of alkaline water has grown by approximately 20% annually over the past few years. This trend is further supported by endorsements from health professionals and wellness influencers, who advocate for the consumption of alkaline water as part of a healthy lifestyle. Consequently, this heightened awareness is driving manufacturers to innovate and expand their product offerings within the Alkaline Water Electrolysis Market.

Regulatory Support and Standards

The Alkaline Water Electrolysis Market is benefiting from increasing regulatory support and the establishment of standards that promote safe and effective water treatment solutions. Governments and health organizations are recognizing the importance of ensuring the quality of drinking water, which includes the promotion of alkaline water as a safe option. Regulatory frameworks are being developed to guide manufacturers in adhering to safety and quality standards, thereby enhancing consumer trust. This regulatory backing not only legitimizes the industry but also encourages new entrants to invest in alkaline water electrolysis technologies. As a result, the Alkaline Water Electrolysis Market is likely to see accelerated growth due to this supportive regulatory environment.

Growing Demand for Functional Beverages

The Alkaline Water Electrolysis Market is witnessing a growing demand for functional beverages, which are perceived as healthier alternatives to traditional soft drinks. Consumers are increasingly seeking beverages that offer health benefits, and alkaline water fits this trend perfectly. Market Research Future indicates that the functional beverage sector is projected to grow at a compound annual growth rate of over 8% in the coming years. This trend is driven by a shift in consumer preferences towards products that promote wellness and hydration. As manufacturers respond to this demand by incorporating alkaline water into their product lines, the Alkaline Water Electrolysis Market is poised for substantial growth, reflecting the broader shift towards health-oriented consumption.

Technological Advancements in Electrolysis

The Alkaline Water Electrolysis Market is experiencing a surge in technological advancements that enhance the efficiency and effectiveness of water electrolysis systems. Innovations in electrode materials and membrane technology are leading to improved energy conversion rates, which are crucial for the production of alkaline water. For instance, the introduction of advanced catalysts has been shown to reduce energy consumption by up to 30%, making the process more economically viable. Furthermore, automation and smart technology integration are streamlining operations, thereby reducing labor costs and increasing production capacity. As these technologies continue to evolve, they are likely to attract more investments, thereby propelling the growth of the Alkaline Water Electrolysis Market.