Sustainability Trends in Production

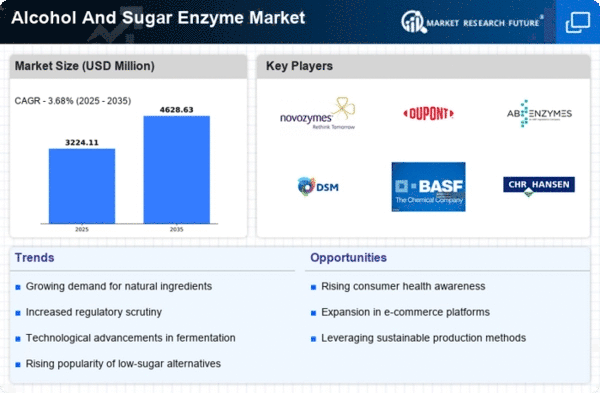

Sustainability trends are becoming increasingly influential in the Global Alcohol And Sugar Enzyme Market Industry. As consumers demand environmentally friendly products, manufacturers are adopting sustainable practices in their production processes. The use of sugar enzymes not only improves fermentation efficiency but also reduces waste and energy consumption. This alignment with sustainability goals is likely to resonate with eco-conscious consumers, thereby enhancing brand loyalty and market share. As the industry moves towards more sustainable practices, the market is projected to grow at a CAGR of 3.67% from 2025 to 2035, reflecting the importance of sustainability in shaping consumer choices.

Rising Demand for Alcoholic Beverages

The Global Alcohol And Sugar Enzyme Market Industry experiences a notable increase in demand for alcoholic beverages, driven by changing consumer preferences and the growing popularity of craft and premium products. As of 2024, the market is valued at approximately 3.11 USD Billion, reflecting a robust consumer inclination towards diverse alcoholic options. This trend is likely to continue, with projections indicating a market growth to 4.62 USD Billion by 2035. The increasing consumption of spirits, wines, and beers necessitates the use of sugar enzymes to enhance fermentation processes, thereby driving the market further.

Health Consciousness and Sugar Reduction

In the Global Alcohol And Sugar Enzyme Market Industry, there is a marked shift towards health consciousness among consumers, leading to a demand for low-sugar and sugar-free alcoholic beverages. This trend is particularly relevant as consumers become more aware of the health implications associated with excessive sugar intake. Consequently, manufacturers are increasingly utilizing sugar enzymes to create beverages that cater to this health-oriented demographic. The market's growth is anticipated to be bolstered by this trend, as consumers seek alternatives that align with their health goals, thereby influencing production strategies and enzyme application.

Regulatory Support for Enzyme Applications

The Global Alcohol And Sugar Enzyme Market Industry benefits from regulatory support that encourages the use of enzymes in food and beverage production. Governments and regulatory bodies are increasingly recognizing the advantages of enzyme applications in enhancing product quality and safety. This support is crucial as it fosters innovation and encourages manufacturers to adopt enzyme technologies in their production processes. As regulations evolve to accommodate new scientific findings, the market is expected to expand, allowing for the introduction of more enzyme-based products that align with consumer preferences and safety standards.

Technological Advancements in Enzyme Production

Technological advancements play a pivotal role in the Global Alcohol And Sugar Enzyme Market Industry, particularly in the production and application of enzymes. Innovations in biotechnology and fermentation processes enhance the efficiency and effectiveness of sugar enzymes, allowing for better yields and improved flavor profiles in alcoholic beverages. These advancements not only optimize production but also reduce costs, making it feasible for manufacturers to experiment with new products. As the industry evolves, the integration of cutting-edge technologies is likely to drive market growth, facilitating the development of novel alcoholic beverages that meet consumer demands.