Market Share

Airport Ground Support Equipment Market Share Analysis

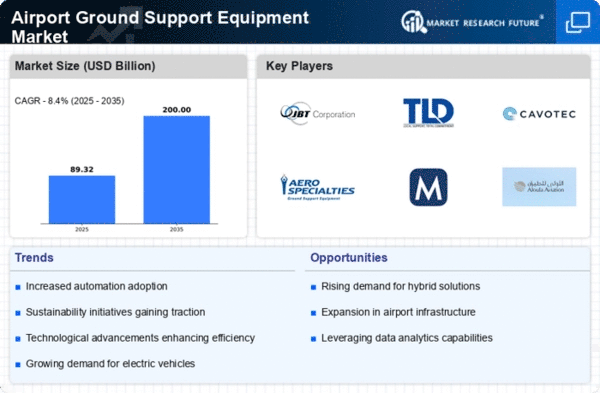

The airport ground support equipment (GSE) market is witnessing notable trends that reflect the evolving needs of the aviation industry and the ongoing efforts to enhance operational efficiency in ground handling operations. One prominent trend is the increasing adoption of electric and alternative fuel-powered GSE. The industry is shifting towards more sustainable practices, driven by a global focus on reducing carbon emissions and environmental impact. As a result, airports and ground handling service providers are increasingly investing in electric GSE, such as electric tugs and baggage tractors, and exploring alternative fuel options, aligning with the trend towards eco-friendly and energy-efficient solutions.

Automation and digitization are emerging as significant trends in the airport GSE market. The integration of automation technologies, including robotics and autonomous vehicles, is transforming ground handling operations. Automated baggage handling systems, robotic cargo loaders, and autonomous tugs are becoming more prevalent, contributing to increased efficiency and reduced turnaround times. Additionally, the adoption of digital solutions, such as telematics and data analytics, is on the rise, enabling real-time monitoring, predictive maintenance, and data-driven decision-making in GSE operations.

Customization and adaptability are key trends influencing the airport GSE market. With the diverse fleet of aircraft types and the varied requirements of different airports, there is a growing demand for GSE solutions that can be customized to specific needs. Manufacturers are increasingly offering modular and adaptable GSE that can cater to various aircraft sizes and operational scenarios. This trend reflects the industry's recognition of the need for versatile and scalable GSE solutions to address the unique challenges posed by different airports and airlines.

The trend towards autonomous and remotely operated GSE is gaining momentum. As technology advances, there is a growing interest in GSE that can operate autonomously or be remotely controlled. Autonomous baggage carts, self-driving buses for passenger transport on the apron, and remotely operated pushback tugs are examples of this trend. The adoption of autonomous GSE aims to enhance safety, reduce manpower requirements, and optimize operational processes, contributing to the overall efficiency of ground handling operations.

The growing emphasis on health and hygiene is influencing trends in the airport GSE market, particularly in response to the challenges posed by the COVID-19 pandemic. Manufacturers are developing GSE solutions with antimicrobial surfaces, touchless controls, and other features that prioritize the health and safety of ground handling personnel and passengers. The trend towards health-conscious GSE aligns with the industry's commitment to ensuring a safe and hygienic airport environment.

Increased connectivity and the Internet of Things (IoT) are impacting the airport GSE market trends. GSE equipped with sensors and connected to the internet enable real-time monitoring and data exchange. This connectivity enhances maintenance practices by providing insights into equipment health, usage patterns, and potential issues. The trend towards IoT-enabled GSE contributes to proactive maintenance strategies, reducing downtime and improving overall equipment reliability.

The adoption of lightweight materials and innovative design approaches is a noteworthy trend in the airport GSE market. Manufacturers are exploring materials that offer high strength-to-weight ratios, contributing to the development of lightweight GSE solutions. The use of composite materials, advanced alloys, and innovative design concepts allows for GSE that is not only lighter but also more fuel-efficient and environmentally friendly. This trend aligns with the industry's pursuit of solutions that optimize energy consumption and reduce the overall ecological footprint of ground handling operations.

The integration of artificial intelligence (AI) and machine learning into airport GSE is a trend that holds great potential for enhancing operational efficiency. AI-powered systems can analyze data, predict equipment failures, and optimize ground handling processes. From predictive maintenance to intelligent routing for baggage handling, the adoption of AI in GSE is expected to contribute to cost savings and improved overall performance.

Leave a Comment