Enhanced Security Measures

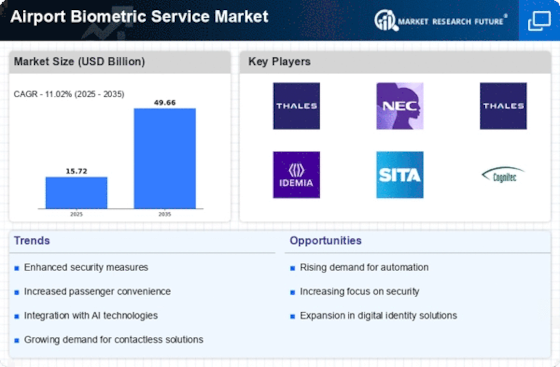

The airport biometric service Market is experiencing a surge in demand for enhanced security measures. With increasing concerns over safety and security at airports, biometric solutions such as facial recognition and fingerprint scanning are being adopted to streamline passenger identification processes. These technologies not only improve security but also reduce the risk of identity fraud. According to recent data, the biometric security market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is driven by the need for airports to comply with stringent security regulations while ensuring a seamless travel experience for passengers. As a result, the integration of biometric services is becoming a critical component of airport security strategies.

Operational Efficiency and Cost Reduction

The Airport Biometric Service Market is increasingly recognized for its potential to enhance operational efficiency and reduce costs. By automating passenger processing through biometric identification, airports can significantly decrease wait times and streamline boarding procedures. This efficiency not only improves passenger satisfaction but also allows airports to allocate resources more effectively. Data indicates that airports implementing biometric solutions have reported reductions in processing times by up to 30%. Furthermore, the reduction in manual checks leads to lower labor costs and minimizes the likelihood of human error. As airports seek to optimize their operations, the adoption of biometric services is likely to become a standard practice, driving growth in the market.

Regulatory Compliance and Standardization

The Airport Biometric Service Market is influenced by the need for regulatory compliance and standardization in security protocols. Governments and aviation authorities are increasingly mandating the use of biometric identification systems to enhance security measures at airports. This regulatory push is driving airports to adopt biometric solutions to ensure compliance with international standards. For instance, the International Civil Aviation Organization has set guidelines that encourage the use of biometric technologies for passenger identification. As airports strive to meet these regulations, the demand for biometric services is expected to rise. This trend not only supports security objectives but also fosters a more uniform approach to passenger processing across different airports.

Growing Demand for Seamless Travel Experiences

The Airport Biometric Service Market is witnessing a growing demand for seamless travel experiences among passengers. Modern travelers increasingly expect quick and hassle-free airport processes, and biometric technologies are well-positioned to meet these expectations. By enabling faster check-ins and boarding procedures, biometric solutions enhance the overall travel experience. Recent studies suggest that over 70% of travelers prefer biometric identification methods over traditional ones due to their convenience. This shift in consumer preference is prompting airports to invest in biometric services to remain competitive. As the travel industry evolves, the emphasis on providing a seamless experience is likely to drive further adoption of biometric technologies in airports.

Technological Advancements in Biometric Solutions

The Airport Biometric Service Market is significantly impacted by rapid technological advancements in biometric solutions. Innovations in artificial intelligence, machine learning, and image processing are enhancing the accuracy and efficiency of biometric systems. These advancements enable airports to implement more sophisticated biometric technologies, such as multi-modal biometric systems that combine facial recognition, iris scanning, and fingerprint analysis. As a result, the reliability of biometric identification is improving, which is crucial for gaining passenger trust. Market data suggests that the biometric technology sector is expected to reach a valuation of several billion dollars in the next few years, driven by these technological improvements. Consequently, the continuous evolution of biometric solutions is likely to propel the growth of the Airport Biometric Service Market.