Increasing Air Travel Demand

The Aircraft Window and Windshield Market is experiencing a notable surge due to the increasing demand for air travel. As more individuals and businesses opt for air transportation, airlines are compelled to expand their fleets. This expansion necessitates the production of new aircraft, which in turn drives the demand for high-quality windows and windshields. According to industry estimates, the commercial aviation sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade. This growth is likely to result in a corresponding increase in the Aircraft Window and Windshield Market, as manufacturers strive to meet the rising needs of airlines and private operators.

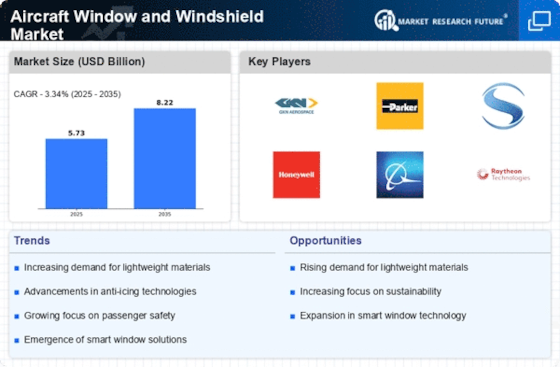

Rising Demand for Lightweight Materials

The Aircraft Window and Windshield Market is witnessing a shift towards lightweight materials, driven by the aviation sector's focus on fuel efficiency and performance. Lightweight windows and windshields contribute to overall aircraft weight reduction, which can lead to lower fuel consumption and operational costs. As airlines increasingly prioritize sustainability and cost-effectiveness, the demand for lightweight solutions is expected to rise. This trend is likely to encourage manufacturers to explore new materials and designs that meet these requirements. Consequently, the Aircraft Window and Windshield Market is poised for growth as stakeholders adapt to these evolving demands.

Regulatory Compliance and Safety Standards

The Aircraft Window and Windshield Market is significantly influenced by stringent regulatory compliance and safety standards. Aviation authorities worldwide impose rigorous requirements for aircraft components, including windows and windshields, to ensure passenger safety and operational efficiency. Compliance with these regulations often necessitates the adoption of advanced materials and manufacturing processes, which can enhance the durability and performance of aircraft windows. As a result, manufacturers are increasingly investing in research and development to innovate and meet these standards. The emphasis on safety is expected to drive the Aircraft Window and Windshield Market, as airlines prioritize the reliability of their fleets.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are reshaping the Aircraft Window and Windshield Market. Innovations such as automated production lines and advanced composite materials are enhancing the efficiency and quality of aircraft windows and windshields. These technologies not only reduce production costs but also improve the performance characteristics of the products, such as weight reduction and increased impact resistance. As manufacturers adopt these cutting-edge technologies, they are likely to gain a competitive edge in the market. The integration of these innovations is expected to propel the Aircraft Window and Windshield Market forward, as stakeholders seek to optimize their operations and product offerings.

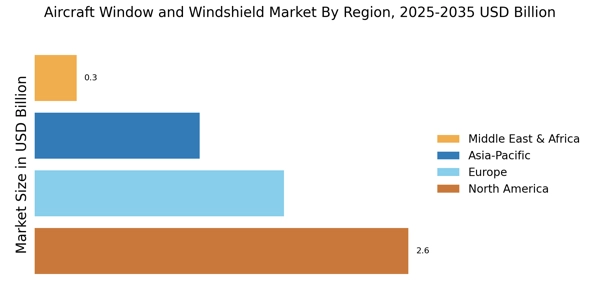

Expansion of Aerospace Manufacturing Facilities

The Aircraft Window and Windshield Market is benefiting from the expansion of aerospace manufacturing facilities across various regions. As countries invest in their aerospace sectors, new production plants are being established, which enhances local manufacturing capabilities. This expansion not only supports the growing demand for aircraft but also fosters innovation and competition among manufacturers. With increased production capacity, companies can respond more effectively to market needs, thereby driving the Aircraft Window and Windshield Market. The establishment of these facilities is likely to create a more robust supply chain, further supporting the industry's growth.