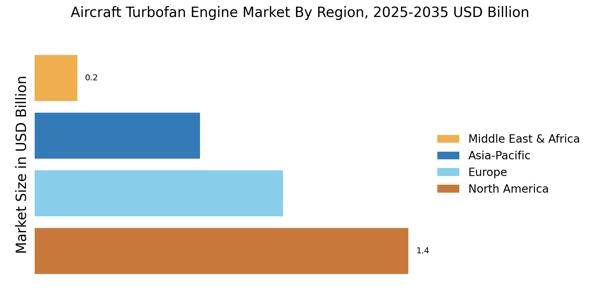

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America Aircraft Turbofan Engine Market will dominate with USD 1.3282 Billion due to the ever-increasing need for innovative technology in the aviation industry and the growing desire for efficient engines. The turbofan engine market in the area is expected to expand significantly during the projection period. The largest market for turboprop aircraft in North America is the United States, followed by Canada.

Due to an increase in turboprop aircraft orders and deliveries in the commercial, military, and general aviation sectors, the United States is anticipated to grow steadily over the next ten years.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2 AIRCRAFT TURBOFAN ENGINE MARKET SHARE BY REGION 2022 (%)

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe’s Aircraft Turbofan Engine Market accounts for the second-largest market share. The increase in trade and passenger transportation has aided in the expansion of the aviation industry. The Aircraft Engines industry has benefited from new and advanced aircraft's increased defensive capability. Further, the German Aircraft Turbofan Engine Market held the largest market share, and the U.K. Aircraft Turbofan Engine Market was the fastest-growing market in the European Region.

The Asia Pacific Aircraft Turbofan Engine Market is expected to grow at the fastest CAGR from 2023 to 2030. Due to the high demand for domestic air travel in developing economies, the Asia-Pacific region is anticipated to experience the highest growth during the forecast period. Passenger traffic decreased in 2020 due to the pandemic, but domestic passenger traffic in nations like China, India, South Korea, and Australia has gradually increased since the second half of 2020.

To support their plans for route expansion, low-cost airlines in the area are strengthening their fleet with new-generation aircraft due to the faster growth of domestic passenger traffic.

To close the gap between the current and required number of squadrons, the Indian Air Force intends to purchase 450 fighter aircraft by 2035 for use on the country's northern and western frontiers. Such fleet modernization plans will likely generate demand for advanced lightweight and fuel-efficient engines over the coming years. Moreover, the India Aircraft Turbofan Engine Market held the largest market share, and the China Aircraft Turbofan Engine Market was the fastest-growing market in the North American Region.