Market Share

Aircraft Tire Market Share Analysis

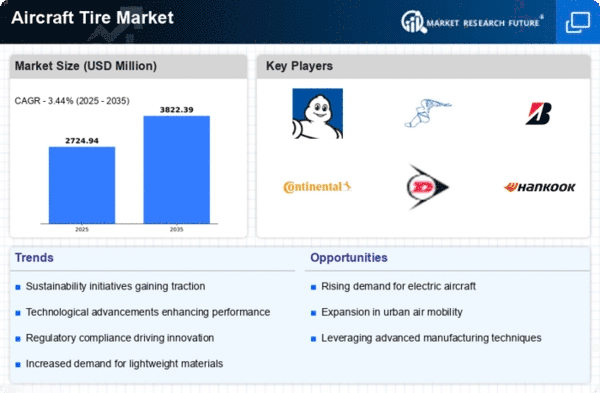

To ensure safe takeoffs and landings and aircraft operational dependability, the aviation industry's market for aircraft tires focuses on long-lasting, high-performing tires. In this competitive sector, companies utilize several market share positioning strategies to establish a significant presence. Tire manufacturers employ product differentiation to set themselves apart from competition. This technique delivers enhanced tread design, durability, and weight optimization. For optimal performance and safety, these aircraft-specific tires are created. They appeal to airlines and operators looking for tires that can handle their fleets' needs. Airplane tire markets get substantial government and financial backing. Following the shutdown, aviation travel has surged in some countries, with more individuals opting to fly for business and pleasure. Also, military aircraft demand is rising in the defense sector. Cost leadership is another key market share positioning strategy for airplane tires. Businesses may become low-cost aircraft tire providers without compromising quality or safety. Cost leadership requires optimizing manufacturing processes, using cost-effective resources, and managing supply chains. This method is ideal for financially strapped airlines and operators looking for reliable and affordable airplane tires. Strategic alliances and collaborations are crucial to aircraft tyre market share positioning. Tire producers work with aircraft manufacturers, maintenance providers, and airlines to expand their market and enhance their goods. Collaboration may lead to the creation of specific tires for particular aircraft, integrated R&D, and entire tire maintenance services. Tire manufacturers can supply complete solutions to the aviation sector's ever-changing needs and build strong relationships with the market's biggest players via these collaborations. Innovation is vital for aviation tyre businesses' market share. Businesses invest much in R&D to create innovative tire innovations that increase performance, fuel economy, and safety. Innovations include using carbon fiber and composite materials for lighter, more durable tires and smart tire technology for real-time tire health and performance monitoring. Tire makers must stay ahead of technological advances to meet aviation sector needs for efficiency and safety. Geographic focus is another key factor in Aircraft Tire market share positioning. Tire producers may tailor their goods to regional aviation markets. Consider weather, runway surfaces, and local aircraft types to achieve this. Suppliers may establish a strong presence in large markets and cooperate with local airlines and operators by tailoring tire designs to local needs.

Leave a Comment