Market Trends

Key Emerging Trends in the Aircraft Fairings Market

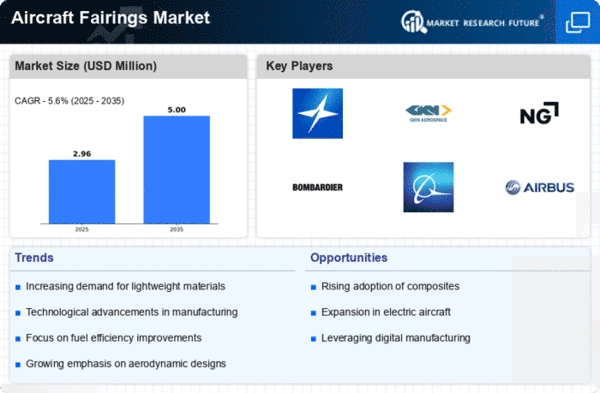

The plane coverings industry is undergoing massive changes that reflect the vibrant nature of the aerospace markets. Over recent years, the aircraft fairing sector has seen some major market trends that have influenced its path. Aerodynamics and fuel efficiency in aircraft design have become some of the main reasons for this move. In order to increase operational efficiency, airlines and manufacturers have been demanding streamlining and aerodynamically optimized fairings. These reduce drag, enhance fuel economy and lead to overall performance improvements.

Furthermore, technological development forms a critical part in determining Aircraft Fairings market trends. This includes increased usage of lightweight composite materials and advanced alloys in their construction among others. Thus shift towards lightweight construction supports sustainability by reducing aircraft weight thus resulting to reduced fuel consumption thereby enhancing fuel efficiency.

Additionally, The increasing focus on environmental sustainability continues to shape market dynamics. For instance, regulatory initiatives and industry-wide commitments aimed at cutting carbon emissions have led to the need for eco-friendly fairings among airplane producers. Fairing designs that are made from recyclable or sustainable materials are part of broader efforts by the industry towards more environmentally friendly aviation practices.

Moreover, the commercial aviation sector has witnessed an upsurge in demand for Aircraft Fairings due to the need for fuel-efficient next generation airplanes as well as improved aerodynamic performance which is lacking in older models being phased out by many carriers today.Specifically, Original Equipment Manufacturers (OEMs) and aftermarket service providers are offering customized fairing solutions that suit contemporary airplane specifications.

In addition, second hand planes popularity across all sectors of transportation has resulted into increased sales within this particular area thereby causing growth into future.The old age aircraft fleets require regular maintenance including replacement necessitating airlines investing heavily in after-market services thereby leading to steady demand for replacement fairings.This trend becomes even more pronounced especially when it’s about aging plane models where upgrading them with much efficient fairings would be considered cost-effective way of extending such aircraft service.

Market trends are also impacted by global partnerships and collaborations. Key players in the Aircraft Fairings industry form alliances with aerospace engineering companies, material suppliers, as well as research organizations. These initiatives are aimed at utilizing the various experiences and resources in order to develop innovative fairing solutions that will be able to meet changing requirements of aviation industry.

However, within the Aircraft Fairings market challenges still exist including complex regulatory environment and certification processes associated with launching new materials and designs. Furthermore, economic uncertainty as well as fuel price fluctuation can affect airline investments thus influencing demand for new airplanes hence affecting need for advanced fairing.”

Leave a Comment