Regulatory Requirements

The aircraft evacuation systems Market is significantly influenced by stringent regulatory requirements imposed by aviation authorities. Organizations such as the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA) mandate that airlines implement effective evacuation systems to ensure passenger safety. Compliance with these regulations is not optional; it is a critical aspect of airline operations. As regulations evolve, airlines are compelled to upgrade their evacuation systems, leading to increased investments in this sector. The market is expected to expand as airlines strive to meet these regulatory standards, which are designed to enhance safety protocols. This regulatory landscape creates a favorable environment for growth within the Aircraft Evacuation Systems Market.

Focus on Passenger Safety

The emphasis on passenger safety is a driving force in the Aircraft Evacuation Systems Market. Airlines are increasingly prioritizing the safety of their passengers, leading to investments in advanced evacuation systems. This focus is not only a response to regulatory requirements but also a strategic move to enhance brand reputation and customer trust. Recent surveys indicate that passengers are more likely to choose airlines that demonstrate a commitment to safety. Consequently, airlines are adopting state-of-the-art evacuation technologies to ensure swift and effective emergency responses. This trend is likely to foster growth in the Aircraft Evacuation Systems Market, as safety becomes a key differentiator in a competitive market.

Technological Innovations

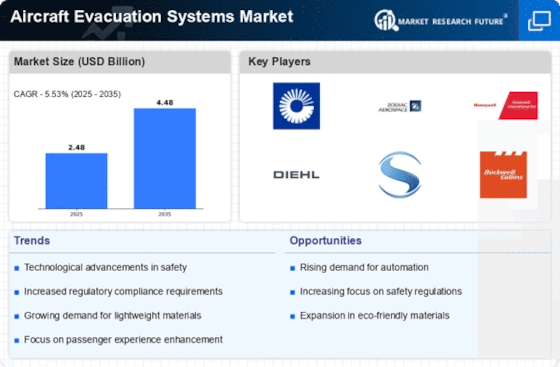

Technological advancements play a pivotal role in shaping the Aircraft Evacuation Systems Market. Innovations such as automated evacuation slides, enhanced lighting systems, and improved materials are being integrated into aircraft designs. These advancements not only enhance the efficiency of evacuation processes but also improve passenger safety during emergencies. The market for evacuation systems is projected to grow at a CAGR of 5.2% from 2025 to 2030, driven by these technological innovations. Manufacturers are increasingly focusing on research and development to create systems that are not only effective but also user-friendly. As technology continues to evolve, the Aircraft Evacuation Systems Market is likely to witness a shift towards more sophisticated and reliable evacuation solutions.

Increasing Air Travel Demand

The Aircraft Evacuation Systems Market is experiencing growth driven by the rising demand for air travel. As more individuals opt for air transportation, airlines are compelled to enhance their safety measures, including evacuation systems. According to recent data, the number of air passengers is projected to reach 8.2 billion by 2037, necessitating robust evacuation solutions. This surge in air travel not only emphasizes the need for efficient evacuation systems but also encourages manufacturers to innovate and improve existing technologies. Airlines are increasingly investing in advanced evacuation systems to ensure passenger safety and compliance with international safety standards. Consequently, this trend is likely to propel the Aircraft Evacuation Systems Market forward, as stakeholders prioritize safety and efficiency in their operations.

Emerging Markets and Airline Expansion

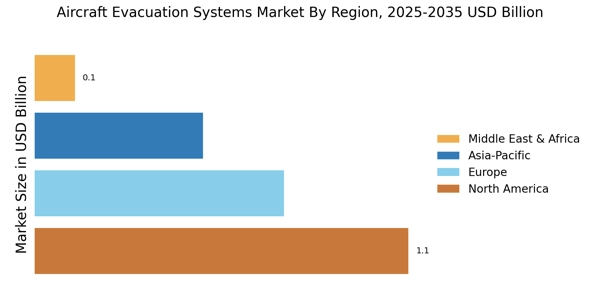

Emerging markets are becoming increasingly important in the Aircraft Evacuation Systems Market. As airlines expand their operations in regions with growing economies, the demand for efficient evacuation systems rises. Countries in Asia and Africa are witnessing a surge in air travel, prompting airlines to invest in modern aircraft equipped with advanced evacuation systems. This expansion is expected to drive the market, as airlines seek to comply with international safety standards while catering to a larger passenger base. The Aircraft Evacuation Systems Market is likely to benefit from this trend, as manufacturers respond to the needs of airlines operating in these emerging markets.