Top Industry Leaders in the Aircraft Engine Fuel Systems Market

Key Players

Key Players

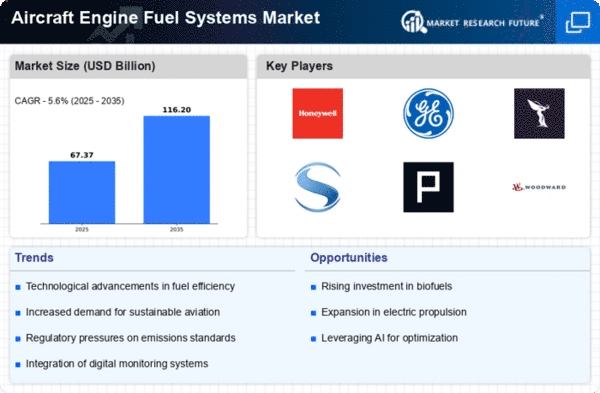

Honeywell International Inc. (US)

Eaton (Ireland)

Parker Hannifin Corporation (US)

Woodward, Inc. (US)

Triumph Group, Inc. (US)

Meggitt PLC (UK)

GKN PLC (UK)

Safran SA (France)

Crane Co. (US)

United Technologies Corporation (US)

Strategies Adopted

Market share analysis in the Aircraft Engine Fuel Systems segment is influenced by critical factors such as the ability to provide reliable and efficient fuel delivery solutions, compliance with stringent aviation regulations, and successful integration with various types of aircraft engines. Pricing strategies play a pivotal role, with companies often customizing their solutions based on the specific requirements of aircraft manufacturers. Establishing strong partnerships with aircraft OEMs, maintenance, repair, and overhaul (MRO) providers, and aviation regulatory bodies is essential for market share, ensuring that fuel systems meet the rigorous safety and performance standards of the aviation industry.

Emerging Companies

While established players dominate the Aircraft Engine Fuel Systems market, new and emerging companies are entering the sector with a focus on niche technologies, such as lightweight components, fuel efficiency enhancements, and digital monitoring systems. The agility of these emerging companies allows them to address specific challenges within the aviation industry, challenging the market dominance of established brands and contributing to the overall innovation within the market.

Industry news within the Aircraft Engine Fuel Systems market frequently highlights advancements in fuel-efficient technologies, successful collaborations with aircraft manufacturers for next-generation platforms, and developments in digital monitoring and predictive maintenance solutions. Companies regularly announce contract wins for the supply of fuel systems to new aircraft programs, partnerships with engine manufacturers for joint technology development, and participation in aviation conferences to showcase their latest innovations. Regulatory updates related to environmental standards, safety requirements, and fuel efficiency goals shape industry dynamics, prompting companies to adapt their technologies and solutions accordingly.

Current trends in company investments within the Aircraft Engine Fuel Systems market reflect a notable focus on sustainability, digitalization, and additive manufacturing. Companies allocate resources to develop lightweight and eco-friendly components, explore the integration of digital sensors for real-time monitoring and predictive maintenance, and invest in additive manufacturing technologies for more efficient and cost-effective production processes. Strategic collaborations with research institutions, participation in industry forums, and investments in test facilities align with the growing demand for innovative and environmentally conscious solutions in the aviation industry.

The overall competitive scenario in the Aircraft Engine Fuel Systems market remains dynamic, with companies navigating evolving aviation regulations, fuel efficiency demands, and technological advancements. Established players face the challenge of maintaining technological leadership in a market where emerging companies are leveraging niche solutions and adapting to changing industry dynamics. The competition is expected to intensify as new entrants secure contracts, introducing innovative fuel system technologies and challenging the market share of established providers. In this environment, adaptability, responsiveness to industry needs, and a commitment to technological excellence will be crucial for companies to maintain and enhance their competitive positions in the Aircraft Engine Fuel Systems market.

Recent News

Partners with GE Aviation to develop hybrid electric propulsion systems for regional jets, aiming to reduce fuel consumption and emissions. (Jan 10, 2024)

Secures $120 million contract from Airbus to supply fuel systems for their A350 freighter aircraft. (Dec 8, 2023)

Successfully tests 100% sustainable aviation fuel (SAF) on a turbofan engine, highlighting progress towards greener aviation. (Nov 4, 2023)

Announces investment in a new research facility focusing on next-generation fuel efficient engine technologies. (Jan 5, 2024)

Collaborates with Boeing to develop fuel-saving systems for the 787 Dreamliner, targeting a 10% reduction in fuel consumption. (Dec 1, 2023)

Releases a white paper outlining its roadmap for achieving net-zero carbon emissions for aviation by 2050. (Oct 20, 2023)

Unveils a new fuel pump technology that promises a 5% reduction in fuel consumption for turbofan engines. (Jan 3, 2024)

Signs a joint venture agreement with Chinese company to develop and manufacture fuel systems for regional jets. (Nov 25, 2023)

Focuses on improving the efficiency and reliability of fuel system components to reduce operating costs for airlines. (Sept 12, 2023)