Market Trends

Key Emerging Trends in the Air Taxi Market

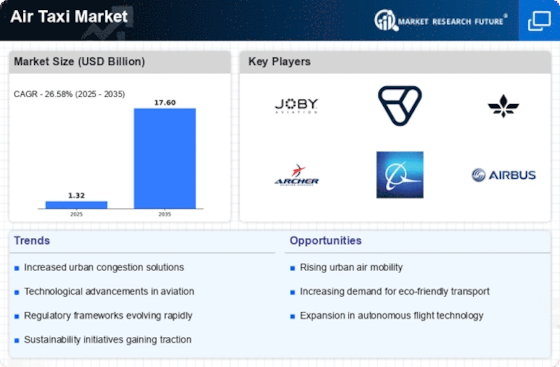

The air taxi market is encountering a surge in energy, driven by a few outstanding patterns that are reshaping the eventual fate of city air transportation. One critical pattern is the developing revenue and interest in electric vertical takeoff and landing (eVTOL) aircraft. With progressions in electric drive innovation, organizations are creating eVTOLs that guarantee a cleaner and quieter method of transportation inside metropolitan conditions. This pattern lines up with the more extensive worldwide push towards sustainable avionics arrangements, addressing concerns connected with fossil fuel byproducts and commotion contamination. One more key pattern in the air taxi market is the rise of various new businesses and established aviation organizations pulling out all the stops. As the market develops, joint effort between flying organizations and innovation firms is turning out to be more typical, further speeding up the advancement of air taxi development. Combination of autonomous flight innovation is a groundbreaking pattern in the air taxi market. While completely autonomous air taxis are not yet generally functional, there is an eminent shift towards the development and testing of autonomous capacities. This pattern aims to improve the security and dependability of air taxi administrations by utilizing artificial intelligence and high-level sensors. As regulatory systems develop to oblige autonomous flying vehicles, the possibility of self-directed air taxis is turning into a substantial reality soon. The creation of infrastructure is a fundamental aspect that shapes the air taxi market patterns. As the demand for urban air versatility grows, the need for suitable vertiports and landing infrastructure becomes increasingly apparent. Organizations and legislatures are investing in the establishment of vertiports - dedicated takeoff and landing areas for air taxis - in order to create the groundwork for a robust organization that can support the consistent integration of these flying vehicles into urban transportation frameworks. Infrastructure development is a critical enabling impact for the widespread acceptance of air taxis, ensuring that metropolitan areas are equipped to manage the operational requirements of this emerging mode of transportation. Customer acknowledgment and the development of a feasible market for air taxi administrations are vital trends in the business. Laying out a positive traveller experience is fundamental for the effective reception of air taxis as a suitable and acknowledged method of urban transportation.

Leave a Comment