Market Share

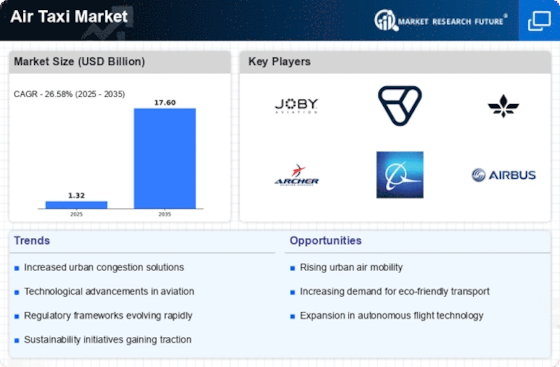

Air Taxi Market Share Analysis

In the quickly developing landscape of the air taxi market, organizations are sending different market share situating methodologies to get an upper hand. One conspicuous methodology revolves around technical separation. With the air taxi industry embracing electric vertical takeoff and landing (eVTOL) aircraft, organizations endeavor to foster state of the art innovations that upgrade effectiveness, security, and passenger experience. Developments in autonomous flight frameworks, energy storage, and lightweight materials put organizations aside as well as position them as pioneers in the competition to offer dependable and high-level air taxi organizations. Organizations aiming for cost authority focus on advancing functional cycles, investigating imaginative assembling procedures, and accomplishing economies of scale. The objective is to give reasonable air taxi administrations, making them open to a more extensive scope of customers. Cost initiative turns into an essential factor as the air taxi market aims to change from a specialty to a mainstream method of transportation, expecting organizations to offset development with cost-viability. Understanding the needs and preferences of potential passengers, including variables such as comfort, openness, and customer experience, enables firms to personalize their services. Offering reliable booking platforms, pleasant interiors, and efficient transportation administrations enhances client satisfaction, encouraging dependability and favorable informal interchange, which contributes to increased market share. Geographic positioning technologies also have an impact on the air taxi sector. Organizations make deliberate decisions on where to deploy their administrations based on criteria such as population density, urbanization trends, and regulatory assistance. Concentrating on areas with high appeal and favorable conditions enables companies to capture market share in areas where air taxi services are likely to thrive, creating the groundwork for more substantial expansion.

Leave a Comment