Growing Demand for Grid Stability

The demand for grid stability is a critical driver for the Air-Cooled Synchronous Condenser Market. As energy systems become more complex with the integration of renewable energy sources, the need for reliable voltage support and reactive power compensation becomes paramount. Synchronous condensers provide essential services that enhance grid reliability, particularly in regions with high penetration of wind and solar energy. Market analysis indicates that the increasing frequency of grid disturbances could lead to a market expansion of around 20% in the next five years, as utilities seek solutions to maintain operational integrity.

Regulatory Support for Clean Energy

Regulatory frameworks are increasingly favoring the adoption of technologies that support clean energy initiatives. The Air-Cooled Synchronous Condenser Market benefits from policies aimed at reducing carbon emissions and promoting renewable energy sources. Governments are implementing incentives for utilities to invest in synchronous condensers, which play a vital role in stabilizing the grid as more intermittent renewable sources are integrated. This regulatory support is expected to drive market growth, with estimates suggesting a potential increase in market size by 15% over the next decade as utilities adapt to evolving energy landscapes.

Increased Focus on Energy Efficiency

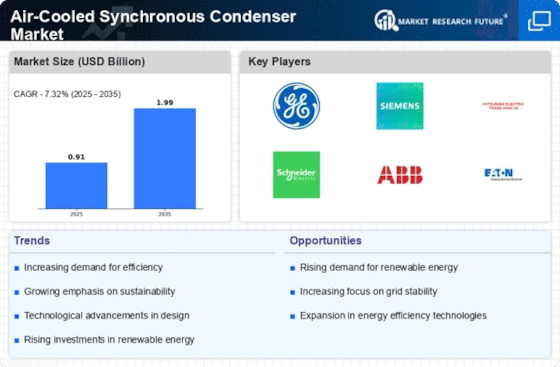

The emphasis on energy efficiency is reshaping the Air-Cooled Synchronous Condenser Market. Utilities and energy providers are under pressure to optimize their operations and reduce energy losses. Air-cooled synchronous condensers offer a viable solution by providing efficient reactive power support, which minimizes energy wastage. The market is witnessing a shift towards more energy-efficient technologies, with projections indicating a potential growth rate of 7% annually as organizations prioritize sustainability. This focus on efficiency not only enhances operational performance but also aligns with broader environmental goals.

Rising Investment in Energy Infrastructure

Investment in energy infrastructure is a significant factor influencing the Air-Cooled Synchronous Condenser Market. As countries modernize their power systems to accommodate growing energy demands, there is a notable increase in funding for new projects. This includes the installation of synchronous condensers, which are essential for enhancing grid performance. Recent reports indicate that investments in energy infrastructure could reach trillions of dollars over the next decade, with a substantial portion allocated to technologies that improve grid resilience. This trend is likely to bolster the market for air-cooled synchronous condensers.

Technological Advancements in Power Generation

The Air-Cooled Synchronous Condenser Market is experiencing a surge in technological advancements that enhance efficiency and reliability. Innovations in materials and design are leading to more compact and efficient condensers, which are crucial for modern power systems. For instance, the integration of advanced control systems allows for better voltage regulation and reactive power support. As a result, the market is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth is driven by the need for improved grid stability and the increasing demand for high-performance power generation solutions.