Increasing Defense Budgets

The Global Air-based Military Electro-optical and Infrared System Market Industry is experiencing growth due to rising defense budgets across various nations. Countries are investing heavily in advanced military technologies to enhance their operational capabilities. For instance, the United States has allocated substantial funds for upgrading its air-based systems, which directly impacts the market. In 2024, the market is projected to reach 8.88 USD Billion, reflecting a growing emphasis on modernizing military assets. This trend indicates a commitment to maintaining technological superiority, thereby driving demand for electro-optical and infrared systems.

Technological Advancements

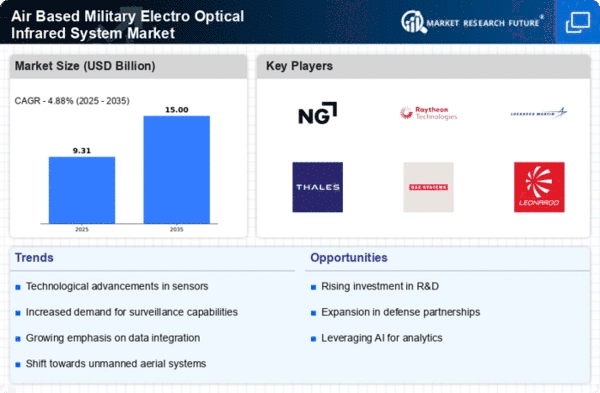

Rapid technological advancements in sensor technologies and imaging systems are propelling the Global Air-based Military Electro-optical and Infrared System Market Industry forward. Innovations such as improved infrared sensors and enhanced image processing capabilities are enabling military forces to achieve superior situational awareness. These advancements allow for better target acquisition and tracking, which are crucial in modern warfare. As a result, the market is expected to grow significantly, with projections indicating a rise to 15 USD Billion by 2035. This growth underscores the importance of integrating cutting-edge technologies into military operations.

Rising Geopolitical Tensions

The Global Air-based Military Electro-optical and Infrared System Market Industry is influenced by escalating geopolitical tensions worldwide. Nations are increasingly aware of the need for advanced surveillance and reconnaissance capabilities to address potential threats. For example, regional conflicts and territorial disputes have prompted countries to enhance their military readiness, leading to increased procurement of air-based electro-optical and infrared systems. This trend is likely to sustain the market's growth trajectory, as nations prioritize investments in technologies that provide strategic advantages in uncertain environments.

Integration of Unmanned Systems

The integration of unmanned systems into military operations is reshaping the Global Air-based Military Electro-optical and Infrared System Market Industry. Unmanned aerial vehicles (UAVs) equipped with advanced electro-optical and infrared sensors are becoming integral to modern warfare. These systems enhance reconnaissance capabilities while reducing risks to personnel. The growing adoption of UAVs for various missions, including surveillance and target acquisition, is driving market expansion. As military forces continue to leverage unmanned systems, the demand for sophisticated electro-optical and infrared technologies is expected to rise, further influencing market dynamics.

Demand for Enhanced Surveillance Capabilities

The demand for enhanced surveillance capabilities is a significant driver of the Global Air-based Military Electro-optical and Infrared System Market Industry. Military forces are increasingly relying on air-based systems for intelligence, surveillance, and reconnaissance (ISR) missions. These systems provide critical data for decision-making and operational planning. The market's growth is further supported by the need for real-time situational awareness in complex operational theaters. As military strategies evolve, the integration of advanced electro-optical and infrared systems becomes essential, contributing to the projected CAGR of 4.88% from 2025 to 2035.