Enhanced Fraud Detection

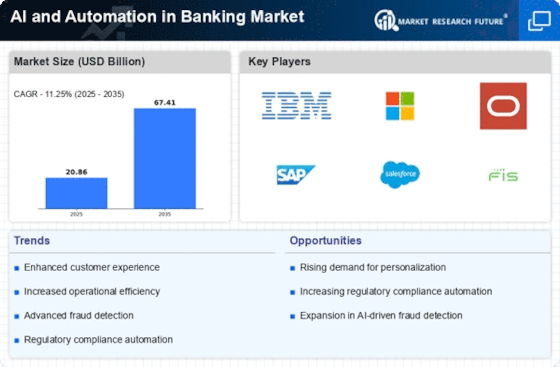

Fraud detection is a critical concern within the AI and Automation in Banking Market. As financial transactions become increasingly digital, the risk of fraud escalates. AI technologies are being deployed to enhance fraud detection mechanisms, utilizing machine learning algorithms to identify unusual patterns and flag potential fraudulent activities in real-time. Recent studies indicate that banks employing AI-driven fraud detection systems can reduce fraud losses by up to 40%. This capability not only protects financial institutions but also fosters customer trust, making enhanced fraud detection a vital driver for the adoption of AI and automation.

Cost Reduction Strategies

In the AI and Automation in Banking Market, cost reduction remains a pivotal driver. Financial institutions are under constant pressure to optimize their operational costs while maintaining service quality. Automation technologies, particularly in back-office operations, have shown potential in reducing labor costs and minimizing human error. Reports suggest that banks implementing AI-driven automation can achieve cost savings of up to 30% in certain processes. This financial incentive encourages banks to adopt AI solutions, as they seek to enhance profitability and remain competitive in a rapidly evolving market landscape.

Data Analytics and Insights

The AI and Automation in Banking Market is significantly shaped by the growing importance of data analytics. Financial institutions are inundated with vast amounts of data, and leveraging this data effectively is crucial for strategic decision-making. AI technologies enable banks to analyze customer behavior, market trends, and risk factors with unprecedented accuracy. As per industry estimates, banks utilizing advanced analytics can improve their decision-making processes by up to 50%. This capability not only enhances customer service but also drives innovation in product offerings, making data analytics a key driver in the adoption of AI and automation.

Regulatory Compliance and Reporting

The AI and Automation in Banking Market is increasingly influenced by the need for stringent regulatory compliance. Financial institutions are required to adhere to a myriad of regulations, which can be complex and resource-intensive. AI technologies facilitate the automation of compliance processes, enabling banks to efficiently monitor transactions and report suspicious activities. According to recent data, the compliance technology market is projected to grow significantly, with AI-driven solutions expected to account for a substantial share. This trend indicates that banks are likely to invest heavily in AI and automation to mitigate risks associated with non-compliance, thereby enhancing their operational integrity.

Customer Personalization and Engagement

The AI and Automation in Banking Market is also driven by the demand for personalized customer experiences. As competition intensifies, banks are recognizing the necessity of tailoring their services to meet individual customer needs. AI technologies enable banks to analyze customer data and preferences, facilitating personalized marketing strategies and product recommendations. Research indicates that personalized banking experiences can lead to a 20% increase in customer engagement. This trend underscores the importance of AI and automation in enhancing customer relationships, thereby driving further investment in these technologies.