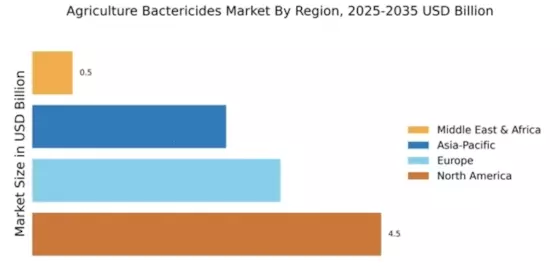

North America : Market Leader in Bactericides

North America is poised to maintain its leadership in the Agriculture Bactericides Market, holding a significant market share of 4.5 in 2024. The region's growth is driven by increasing agricultural productivity demands, stringent regulations promoting sustainable practices, and advancements in biopesticide technologies. The rising awareness of food safety and environmental concerns further fuels the demand for effective bactericides.

The competitive landscape in North America is characterized by the presence of major players such as BASF SE, Bayer AG, and Corteva Agriscience. These companies are investing heavily in R&D to innovate and expand their product portfolios. The U.S. and Canada are the leading countries, with robust agricultural sectors that prioritize crop protection solutions. The regulatory environment is supportive, encouraging the adoption of new technologies and sustainable practices.

Europe : Regulatory-Driven Market Growth

Europe's Agriculture Bactericides Market is projected to grow significantly, with a market size of 3.2 by 2025. The region's growth is primarily driven by stringent EU regulations aimed at reducing chemical residues in food and promoting sustainable agricultural practices. The increasing consumer demand for organic produce and environmentally friendly solutions is also a key factor influencing market dynamics.

Leading countries in this region include Germany, France, and the Netherlands, where major players like Syngenta AG and BASF SE are actively engaged. The competitive landscape is marked by innovation and collaboration among stakeholders to develop effective bactericides that comply with regulatory standards. The European market is characterized by a strong emphasis on research and development, ensuring the availability of advanced agricultural solutions.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a burgeoning Agriculture Bactericides Market, with a projected size of 2.5 by 2025. The growth is driven by increasing agricultural activities, rising population demands, and the need for enhanced crop protection solutions. Countries like India and China are focusing on modernizing their agricultural practices, which is propelling the demand for effective bactericides to combat crop diseases.

In this region, the competitive landscape is evolving, with key players such as UPL Limited and ADAMA Agricultural Solutions Ltd. making significant inroads. The presence of diverse agricultural practices across countries presents both challenges and opportunities for market players. As governments promote initiatives to improve agricultural productivity, the demand for innovative bactericides is expected to rise, fostering a dynamic market environment.

Middle East and Africa : Untapped Agricultural Potential

The Middle East and Africa region, with a market size of 0.52, presents significant growth opportunities in the Agriculture Bactericides Market. The region's agricultural sector is gradually evolving, driven by increasing investments in agricultural technology and the need for improved crop yields. Factors such as climate change and water scarcity are pushing farmers to seek effective solutions for pest and disease management, thereby boosting the demand for bactericides.

Countries like South Africa and Kenya are at the forefront of this growth, with a rising number of local and international players entering the market. The competitive landscape is characterized by a mix of established companies and emerging startups focusing on innovative agricultural solutions. As awareness of sustainable practices grows, the market is expected to expand, offering new avenues for growth and development.