Sustainability Focus

The Agriculture and Farm Machinery Market is increasingly aligning with sustainability goals, as environmental concerns become paramount. Farmers are now prioritizing eco-friendly practices, which has led to a rise in demand for machinery that minimizes environmental impact. Equipment designed for reduced emissions and lower fuel consumption is gaining traction. For example, the market for electric and hybrid farm machinery is expected to grow significantly, with projections indicating a 15% increase in sales over the next five years. This shift towards sustainable practices not only addresses regulatory pressures but also appeals to environmentally conscious consumers. Consequently, the Agriculture and Farm Machinery Market is adapting to these changes, fostering innovation in sustainable machinery solutions that meet the evolving needs of the agricultural sector.

Rising Global Food Demand

The Agriculture and Farm Machinery Market is significantly influenced by the rising global food demand, driven by population growth and changing dietary preferences. As the world population is projected to reach 9.7 billion by 2050, the need for increased agricultural output becomes imperative. This demand necessitates the adoption of advanced farming techniques and machinery to enhance productivity. Data suggests that agricultural machinery sales are expected to grow by 5% annually, as farmers seek efficient solutions to meet this escalating demand. The Agriculture and Farm Machinery Market is thus positioned to benefit from this trend, as innovations in machinery play a crucial role in boosting crop yields and ensuring food security.

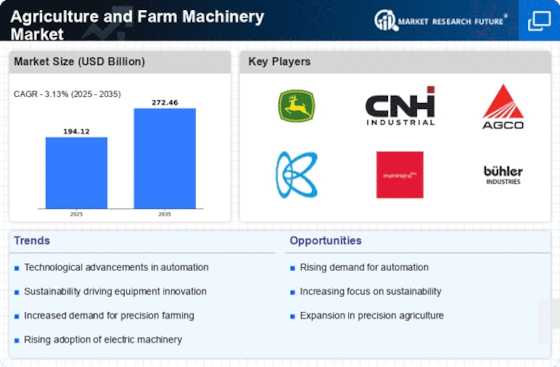

Technological Advancements

The Agriculture and Farm Machinery Market is currently experiencing a surge in technological advancements, which are transforming traditional farming practices. Innovations such as precision agriculture, autonomous machinery, and data analytics are enhancing productivity and efficiency. For instance, the integration of GPS technology in tractors allows for more accurate planting and resource management. According to recent data, the adoption of smart farming technologies is projected to increase by 20% annually, indicating a robust shift towards automation. This trend not only reduces labor costs but also optimizes resource utilization, thereby contributing to sustainable farming practices. As farmers increasingly embrace these technologies, the Agriculture and Farm Machinery Market is likely to witness significant growth, driven by the demand for more efficient and effective farming solutions.

Increased Investment in R&D

Investment in research and development is a critical driver for the Agriculture and Farm Machinery Market. As competition intensifies, companies are allocating substantial resources to innovate and improve their product offerings. This focus on R&D is essential for developing advanced machinery that meets the demands of modern agriculture. Recent statistics indicate that R&D spending in the agricultural sector has increased by approximately 10% annually, reflecting a commitment to enhancing efficiency and productivity. Innovations stemming from this investment include improved crop management systems and enhanced machinery capabilities. As a result, the Agriculture and Farm Machinery Market is poised for growth, as new technologies emerge to address the challenges faced by farmers worldwide.

Government Support and Subsidies

Government support and subsidies are pivotal in shaping the Agriculture and Farm Machinery Market. Many governments are implementing policies aimed at modernizing agriculture, which includes financial incentives for purchasing advanced machinery. These subsidies not only lower the financial burden on farmers but also encourage the adoption of innovative technologies. Recent reports indicate that countries are increasing their agricultural budgets, with some allocating up to 30% for machinery and technology upgrades. This support is crucial for enhancing the competitiveness of the agricultural sector. As a result, the Agriculture and Farm Machinery Market is likely to experience growth, driven by favorable government policies that promote investment in modern farming equipment.