Top Industry Leaders in the Agricultural Pheromones Market

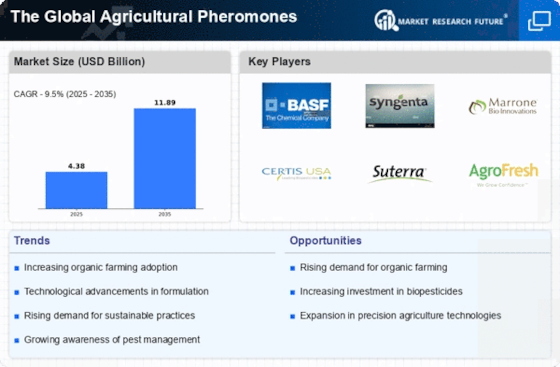

The agricultural pheromones market is a burgeoning sector. These naturally occurring insect attractants offer a sustainable and targeted approach to pest control, driving their adoption across the globe. The market is characterized by a mix of established players and emerging startups, creating a dynamic competitive landscape.

List of Strategies Adopted:

- Product Differentiation: Leading companies like ISCA Technologies and Suterra are investing in research and development to create novel pheromone blends and delivery systems, catering to specific pest and crop needs. For example, Suterra's Isagro LUREntice utilizes a unique dispenser for codling moth control, offering sustained release and reduced environmental impact.

- Geographical Expansion: Established players like Biobest are actively expanding into emerging markets like Asia-Pacific and Latin America, capitalizing on the growing demand for sustainable pest control solutions. Local acquisitions and partnerships further strengthen their presence in these regions.

- Vertical Integration: Some players, like Russell IPM, are vertically integrating their operations, controlling the entire value chain from pheromone synthesis to trap manufacturing and distribution. This enhances cost efficiency and ensures quality control throughout the process.

- Collaboration and Partnerships: Strategic partnerships are common, with companies teaming up with research institutions, universities, and other agritech players to accelerate innovation and develop new applications for pheromones. For example, ISCA Technologies partnered with the University of California, Riverside, to explore the use of pheromones for controlling invasive spotted lanternflies.

- Digitalization and Automation: The adoption of digital technologies like precision agriculture and smart traps is gaining traction. Companies like Bio-Control Tech are developing pheromone-based traps equipped with sensors that monitor pest activity and trigger automated release mechanisms, optimizing pest control strategies.

Factors for Market Share:

- Product Portfolio and Efficacy: Companies with a diverse range of pheromone products for different pests and crops hold a competitive advantage. Strong efficacy data and field trials are crucial to establishing trust and market share.

- Regulatory Compliance: Navigating the complex regulatory landscape for pheromone registration and use varies by region. Companies with established regulatory expertise and compliance procedures gain an edge.

- Pricing and Distribution Channels: Competitive pricing strategies and efficient distribution networks are essential for reaching a wider audience, especially in price-sensitive markets.

- Brand Reputation and Customer Relationships: Building trust and long-term relationships with farmers and agricultural businesses is key for sustained growth.

List of Key Players in the Agricultural Pheromones Market

- Russell IPM

- Shin-Etsu Chemical Company

- Isagro S.p.A.

- Biobest Group

- SEDQ Healthy Crops SL

- ISCA Global

- Suterra LLC

- Provivi, Inc.

- Koppert Biological Systems

- Pacific Biocontrol Corporation

Recent Developments:

August 2023: ISCA Technologies receives a USD 10 million grant from the USDA to develop novel pheromone-based lures for controlling citrus canker disease.

September 2023: Biobest acquires Koppert Biological Systems, a leading player in biocontrol solutions, strengthening its position in the European market.

October 2023: Suterra partners with a Chinese agricultural technology company to launch a pheromone-based pest control program for cotton crops in China.

November 2023: The US EPA approves the registration of a new pheromone lure for controlling the invasive brown marmorated stink bug.

December 2023: The Indian government announces a new initiative to promote the adoption of pheromone-based pest control technologies in smallholder farms.

January 2024: A team of researchers from the University of California, Berkeley, develops a genetically modified crop that emits its own pheromones to repel pests, marking a potential breakthrough in pest control strategies.