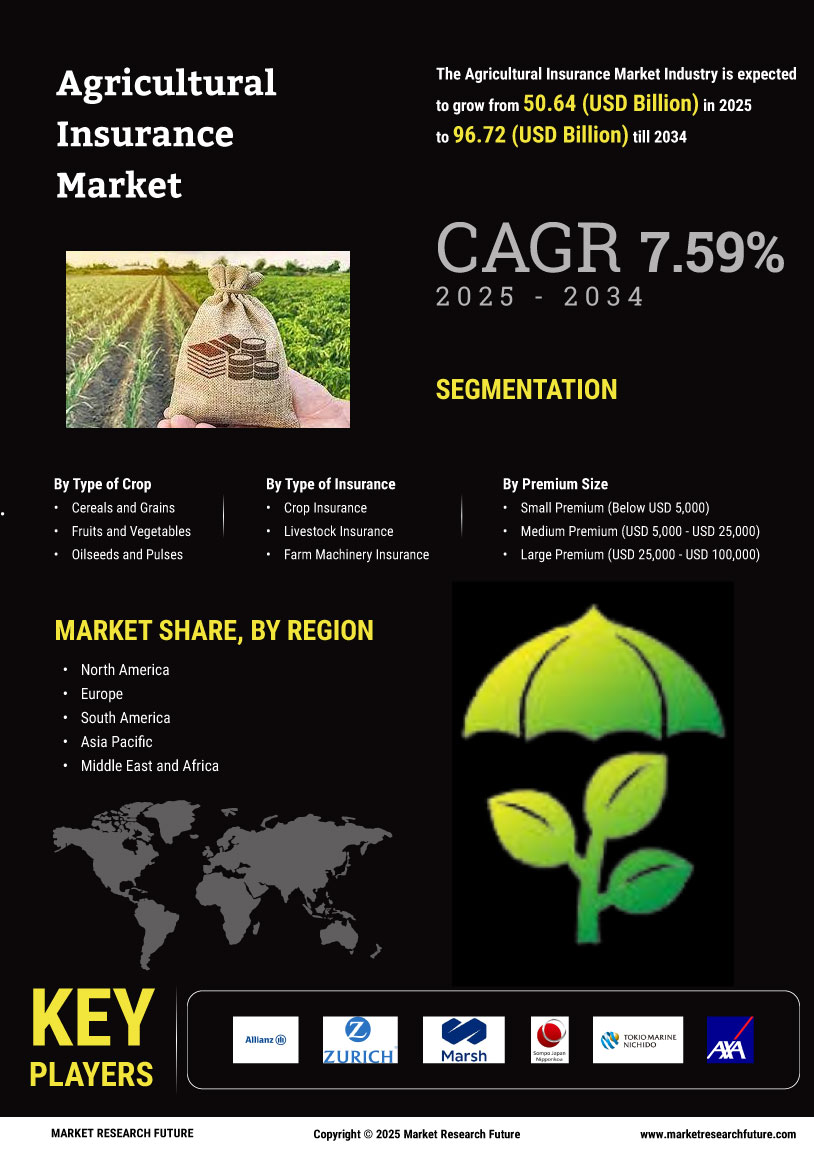

Climate Change Impact

The Agricultural Insurance Market is increasingly influenced by the effects of climate change, which has led to more frequent and severe weather events. Farmers face heightened risks from droughts, floods, and storms, prompting a greater need for insurance products that can mitigate these risks. According to recent data, the frequency of extreme weather events has increased by approximately 30% over the last decade, underscoring the urgency for robust insurance solutions. As a result, agricultural insurance providers are adapting their offerings to include coverage for climate-related risks, thereby expanding their market reach and enhancing their value propositions. This shift not only protects farmers but also stabilizes agricultural production, which is vital for food security. Consequently, the demand for agricultural insurance is expected to rise as stakeholders seek to safeguard their investments against unpredictable climatic conditions.

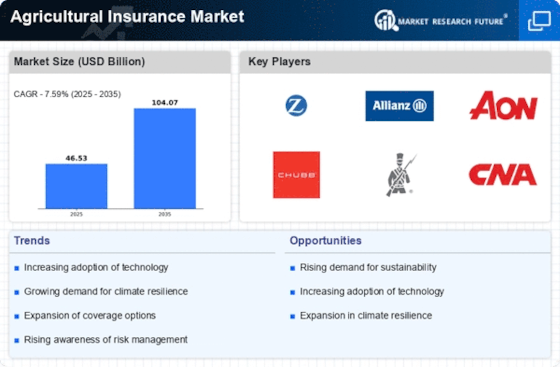

Technological Advancements

Technological advancements play a pivotal role in shaping the Agricultural Insurance Market. Innovations such as satellite imagery, drones, and data analytics are revolutionizing how insurers assess risk and manage claims. For instance, the use of remote sensing technology allows insurers to monitor crop health and yield predictions with unprecedented accuracy. This capability enhances underwriting processes and enables more tailored insurance products. Furthermore, the integration of artificial intelligence in risk assessment models is streamlining operations and improving customer service. As technology continues to evolve, it is anticipated that the agricultural insurance sector will witness a surge in efficiency and effectiveness, ultimately leading to increased adoption rates among farmers. The potential for technology to transform the industry is immense, suggesting that insurers who embrace these advancements may gain a competitive edge in the marketplace.

Increasing Crop Diversification

Increasing crop diversification is emerging as a significant trend within the Agricultural Insurance Market. Farmers are increasingly adopting diverse cropping systems to mitigate risks associated with monoculture practices. This diversification not only enhances soil health and reduces pest pressures but also creates a demand for tailored insurance products that cater to various crops. As farmers expand their portfolios to include a wider range of crops, insurers are responding by developing specialized policies that address the unique risks associated with different agricultural products. Recent data indicates that regions with diversified cropping systems have experienced a 15% reduction in crop failure rates, highlighting the benefits of this approach. This trend suggests that as more farmers recognize the advantages of diversification, the agricultural insurance market will likely see an uptick in demand for customized insurance solutions that align with these evolving practices.

Rising Awareness of Risk Management

There is a growing awareness among farmers regarding the importance of risk management, which significantly influences the Agricultural Insurance Market. As agricultural practices become more complex and market volatility increases, farmers are recognizing the necessity of protecting their investments through insurance. Recent surveys indicate that approximately 60% of farmers now consider insurance as a critical component of their risk management strategy. This shift in mindset is driving demand for comprehensive insurance products that address various risks, including crop failure, livestock loss, and market fluctuations. Insurers are responding by developing more flexible and accessible policies tailored to the specific needs of farmers. This trend not only enhances the resilience of agricultural operations but also contributes to the overall stability of the agricultural sector, indicating a positive trajectory for the agricultural insurance market.

Government Initiatives and Subsidies

Government initiatives and subsidies are crucial drivers of the Agricultural Insurance Market. Many governments recognize the importance of agricultural insurance in promoting food security and supporting farmers. As a result, they are implementing policies that encourage the uptake of insurance products. For instance, some countries offer premium subsidies to farmers, making insurance more affordable and accessible. Data suggests that regions with strong government support for agricultural insurance have seen a 25% increase in policy uptake over the past few years. These initiatives not only alleviate the financial burden on farmers but also foster a culture of risk management within the agricultural community. Consequently, the presence of supportive government policies is likely to enhance the growth prospects of the agricultural insurance market, as more farmers seek to protect their livelihoods against unforeseen events.