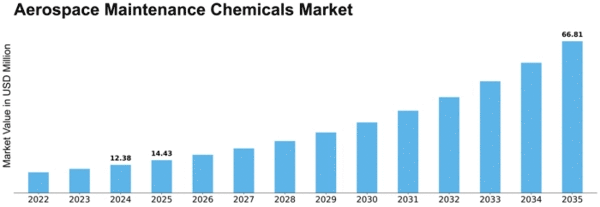

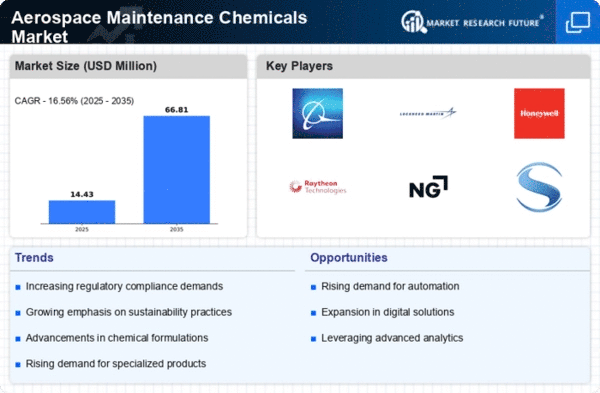

Aerospace Maintenance Chemicals Size

Aerospace Maintenance Chemicals Market Growth Projections and Opportunities

Aerospace maintenance chemicals play a pivotal role in ensuring the safety, efficiency, and longevity of aircraft components. The market factors influencing these specialized chemicals span a wide spectrum, ranging from technological advancements to regulatory requirements and market dynamics.

Technological Innovations stand as a cornerstone factor in shaping the aerospace maintenance chemicals market. Ongoing advancements in material science and chemical engineering lead to the development of more efficient and environmentally friendly products. For instance, the emergence of eco-friendly formulations that comply with stringent environmental regulations has significantly impacted market preferences. These innovations drive the demand for chemicals that offer enhanced performance while minimizing environmental impact.

Regulatory Compliance acts as a significant driving force within this market. Stringent regulations imposed by aviation authorities and environmental agencies necessitate the use of chemicals that meet stringent safety and environmental standards. Aerospace maintenance chemicals must adhere to strict guidelines to ensure they don’t compromise the safety or structural integrity of aircraft components. Consequently, companies invest in research and development to formulate products that meet these regulatory requirements, thereby influencing market dynamics.

Market Dynamics encompass various elements such as supply chain complexities, market competition, and customer preferences. The market is influenced by factors like the global fleet size, which impacts the demand for maintenance chemicals. Additionally, the competitive landscape with numerous players vying for market share leads to innovation and competitive pricing strategies. Customer preferences for efficient, cost-effective, and sustainable solutions further steer market trends, influencing the development and adoption of specific maintenance chemicals.

Economic Trends significantly impact the aerospace maintenance chemicals market. Fluctuations in the global economy, including fuel prices, interest rates, and geopolitical factors, can influence airline spending and, consequently, their expenditure on maintenance chemicals. Moreover, the market's susceptibility to economic downturns can affect the purchasing power and investment decisions of airlines and maintenance providers, directly impacting the demand for these chemicals.

Environmental Concerns have increasingly shaped market dynamics in recent years. The industry's drive towards sustainability has led to a heightened focus on environmentally friendly products. Aerospace maintenance chemicals that are biodegradable, non-toxic, and have minimal ecological impact gain traction due to growing environmental awareness and stringent regulations aiming to reduce the carbon footprint of aviation operations.

Market Expansion Opportunities arise from the burgeoning aerospace industry. The continuous growth in air passenger traffic, coupled with increasing aircraft fleets globally, opens avenues for market expansion. Emerging markets in Asia-Pacific, Latin America, and the Middle East exhibit significant potential for growth due to rising air travel demand, thereby fostering opportunities for aerospace maintenance chemicals manufacturers to expand their market presence.

Leave a Comment