North America : Market Leader in Aerospace Insulation

North America is poised to maintain its leadership in the aerospace insulation market, holding a significant share of 3.82 billion in 2024. The region's growth is driven by increasing demand for lightweight and efficient insulation materials, spurred by stringent regulations aimed at enhancing fuel efficiency and reducing emissions. The presence of major aerospace manufacturers and a robust supply chain further catalyze market expansion.

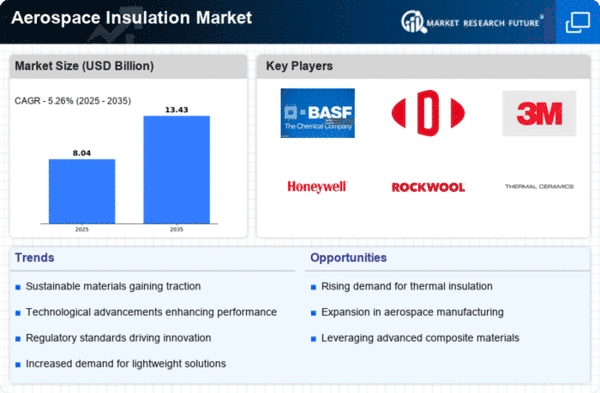

The United States stands out as the leading country, hosting key players such as DuPont, 3M, and Honeywell. These companies are at the forefront of innovation, developing advanced insulation solutions tailored for aerospace applications. The competitive landscape is characterized by strategic partnerships and investments in R&D, ensuring that North America remains a hub for aerospace technology advancements.

Europe : Emerging Market with Growth Potential

Europe's aerospace insulation market is projected to grow, with a market size of 2.15 billion in 2024. The region benefits from a strong regulatory framework promoting sustainable aviation practices, which drives demand for advanced insulation materials. Initiatives aimed at reducing carbon footprints and enhancing energy efficiency are key growth catalysts, aligning with the EU's Green Deal objectives.

Leading countries like Germany, France, and the UK are pivotal in this market, hosting major players such as BASF and Rockwool. The competitive landscape is marked by innovation and collaboration among manufacturers, focusing on developing eco-friendly insulation solutions. The presence of established aerospace companies further strengthens the market, positioning Europe as a significant player in the global aerospace insulation sector.

Asia-Pacific : Rapidly Growing Aerospace Sector

The Asia-Pacific aerospace insulation market is on an upward trajectory, with a market size of 1.4 billion in 2024. This growth is fueled by increasing air travel demand and the expansion of the aerospace manufacturing sector in countries like China and India. Regulatory support for aviation safety and efficiency is also a significant driver, encouraging investments in advanced insulation technologies.

China leads the region, with substantial investments in aerospace infrastructure and a growing number of domestic manufacturers. The competitive landscape features both local and international players, including 3M and Honeywell, who are actively expanding their presence. The region's focus on innovation and sustainability is expected to further enhance its market position in the global aerospace insulation industry.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa aerospace insulation market, valued at 0.27 billion in 2024, is gradually emerging, driven by increasing investments in aviation infrastructure and a growing demand for air travel. However, challenges such as regulatory hurdles and limited local manufacturing capabilities hinder rapid growth. The region's focus on enhancing aviation safety standards is expected to catalyze demand for advanced insulation materials.

Countries like the UAE and South Africa are leading the way, with initiatives aimed at boosting their aerospace sectors. The competitive landscape is still developing, with a few key players like Aerospace Insulation Technologies beginning to establish a foothold. As the region invests in its aviation capabilities, the aerospace insulation market is likely to see gradual growth in the coming years.