Aerospace Fasteners Size

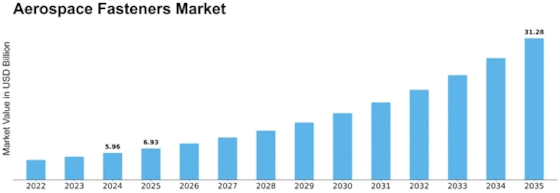

Aerospace Fasteners Market Growth Projections and Opportunities

The Aerospace Fasteners market stands at the convergence of a few key factors that all in all impact its elements and development direction. One major driver of this market is the ceaseless extension of the aerospace business. As worldwide air head out proceeds to rise and states put resources into protection abilities, the demand for airplane creation and maintenance heightens. Aerospace fasteners, including screws, fasteners, nuts, and bolts, are vital parts in building and collecting airplane. Therefore, the development of the aerospace business straightforwardly pushes the demand for aerospace fasteners. High level manufacturing procedures, including precision machining and 3D printing, empower the development of complex and modified fasteners, encouraging proficiency in airplane assembly. These innovative steps hoist the exhibition of aerospace fasteners as well as drive market development by lining up with the business' advancing requirements. The aerospace fasteners market is similarly unpredictably connected to the administrative landscape administering flight security and standards. Tough guidelines and affirmation processes mandate the utilization of high-quality and reliable fasteners in aerospace applications. As security stays vital in aeronautics, adherence to administrative necessities guarantees the trustworthiness of airplane structures. Manufacturers in the aerospace fasteners market should follow these standards, impacting the market by encouraging a culture of quality confirmation and dependability. Original Equipment Manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) specialist co-ops add to the market's energy, with each portion having one of a kind demands for aerospace fasteners. Market players endeavor to separate themselves through item quality, dependability, and the capacity to give redid arrangements, establishing a dynamic and serious climate. Natural maintainability contemplations are progressively becoming persuasive in the aerospace business, including the aerospace fasteners market. As the avionics area looks to lessen its natural impression, manufacturers and providers are investigating lightweight materials and eco-friendly manufacturing processes for fasteners. This pattern lines up with more extensive worldwide endeavors to improve maintainability, setting out open doors for advancement inside the aerospace fasteners market that resound with ecological worries.

Leave a Comment