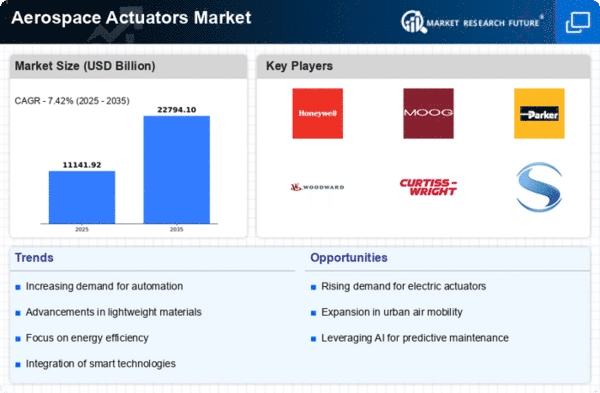

Market Growth Projections

The Global aerospace actuators Market Industry is poised for substantial growth, with projections indicating an increase from 10.7 USD Billion in 2024 to 15.5 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate of 3.45% from 2025 to 2035. The market dynamics are shaped by various factors, including technological advancements, regulatory compliance, and the expanding military and commercial aerospace sectors. As the industry evolves, stakeholders are likely to focus on innovation and efficiency to capitalize on emerging opportunities, ensuring sustained growth in the coming years.

Growing Military Aerospace Sector

The military aerospace sector represents a substantial driver for the Global Aerospace Actuators Market Industry. Increased defense budgets and modernization programs across various nations are fueling demand for advanced actuator systems in military aircraft. These systems are critical for enhancing maneuverability, control, and overall operational effectiveness. For example, the integration of advanced actuators in unmanned aerial vehicles (UAVs) and fighter jets is becoming increasingly prevalent. As governments prioritize defense capabilities, the military aerospace segment is expected to contribute significantly to the market's growth, aligning with the overall industry expansion projected to reach 15.5 USD Billion by 2035.

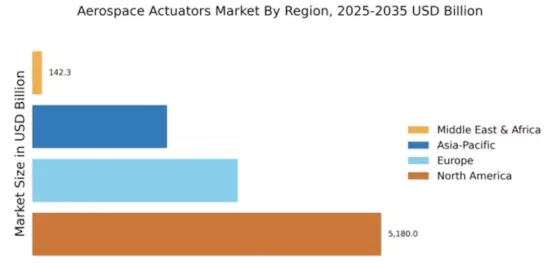

Emerging Markets and Globalization

Emerging markets are becoming increasingly influential in the Global Aerospace Actuators Market Industry, driven by globalization and rising air travel demand. Countries in Asia-Pacific and Latin America are witnessing rapid growth in their aerospace sectors, leading to increased investments in actuator technologies. For instance, the expansion of low-cost carriers in these regions is driving the need for efficient and reliable actuator systems. As these markets develop, they present lucrative opportunities for actuator manufacturers, contributing to the industry's projected growth. The Global Aerospace Actuators Market is expected to reach 15.5 USD Billion by 2035, reflecting the impact of these emerging economies.

Increasing Demand for Lightweight Aircraft

The Global Aerospace Actuators Market Industry experiences a notable surge in demand for lightweight aircraft, driven by the aviation sector's focus on fuel efficiency and reduced emissions. Aircraft manufacturers are increasingly adopting advanced materials and technologies to minimize weight, which directly influences actuator design and functionality. For instance, the integration of composite materials in actuator systems enhances performance while reducing overall weight. This trend is projected to contribute to the market's growth, with the industry valued at 10.7 USD Billion in 2024 and expected to reach 15.5 USD Billion by 2035, reflecting a compound annual growth rate of 3.45% from 2025 to 2035.

Regulatory Compliance and Safety Standards

The Global Aerospace Actuators Market Industry is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities worldwide. These regulations necessitate the incorporation of advanced actuator systems that meet safety and performance benchmarks. Manufacturers are compelled to invest in high-quality actuator technologies to ensure compliance, thereby driving market growth. For instance, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) enforce rigorous testing and certification processes for aerospace components. This regulatory landscape fosters innovation and enhances the demand for sophisticated actuators, contributing to the industry's anticipated growth trajectory.

Technological Advancements in Actuator Systems

Technological advancements play a pivotal role in shaping the Global Aerospace Actuators Market Industry. Innovations such as smart actuators, which incorporate sensors and control systems, enhance the precision and reliability of aircraft operations. These advancements not only improve safety but also optimize performance, leading to increased adoption by manufacturers. For example, the development of electro-mechanical actuators offers advantages over traditional hydraulic systems, including reduced maintenance and improved energy efficiency. As these technologies continue to evolve, they are likely to drive market growth, aligning with the industry's projected value increase to 15.5 USD Billion by 2035.