Market Analysis

In-depth Analysis of Aerospace 3D Printing Market Industry Landscape

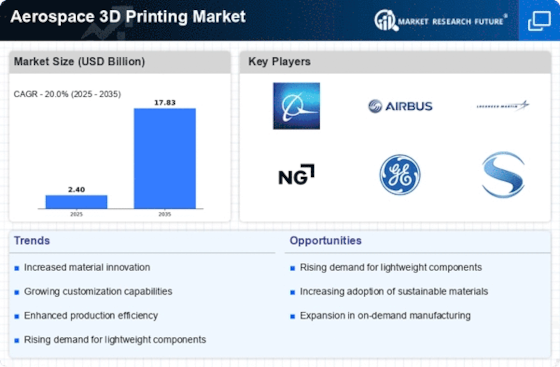

The market dynamics of the Aerospace 3D Printing industry reflect a landscape defined by technological innovation, growing demand for lightweight components, and a shift toward more sustainable manufacturing practices. As the aerospace sector continually seeks advancements, 3D printing has emerged as a transformative force. This market is characterized by a steady upward trajectory, driven by a combination of factors.

One key driver is the increasing need for lightweight materials in aerospace manufacturing. Traditional manufacturing methods often involve subtractive processes that generate excess waste and result in heavier components. Aerospace 3D printing, on the other hand, enables the creation of intricate designs with optimized structures, significantly reducing weight without compromising strength. This is particularly crucial for the aerospace industry, where every kilogram saved contributes to fuel efficiency and overall performance.

Technological advancements play a pivotal role in shaping the dynamics of the Aerospace 3D Printing market. Continuous improvements in 3D printing technologies, such as selective laser sintering (SLS) and fused deposition modeling (FDM), have expanded the range of materials that can be used in aerospace applications. This has opened up new possibilities for producing complex and high-performance parts, including engine components, structural elements, and even entire airframe sections. The evolution of 3D printing capabilities enhances the industry's ability to meet stringent aerospace standards while pushing the boundaries of design possibilities.

Furthermore, the market is influenced by the aerospace industry's increasing focus on sustainability. 3D printing allows for the efficient use of materials, reducing waste and environmental impact compared to traditional manufacturing processes. Manufacturers in the aerospace sector are recognizing the importance of environmentally friendly practices, aligning with global efforts to create a more sustainable future. As a result, the Aerospace 3D Printing market is not only driven by economic considerations but also by a broader commitment to environmental responsibility.

Global economic factors also contribute to the market dynamics. The aerospace industry, being inherently linked to economic cycles, experiences fluctuations in demand for commercial and military aircraft. However, 3D printing offers a degree of flexibility that allows manufacturers to adapt quickly to changing market conditions. The ability to rapidly prototype and produce customized components aligns well with the aerospace industry's need for agility in responding to market dynamics.

Challenges and opportunities coexist in this evolving landscape. While the Aerospace 3D Printing market is expanding, there are hurdles to overcome, including regulatory concerns, material certification, and the need for standardized processes. Addressing these challenges will be crucial for widespread adoption and sustained growth in the sector. On the flip side, the market presents immense opportunities for companies that can navigate these challenges successfully. Investment in research and development, collaboration with regulatory bodies, and strategic partnerships can position companies at the forefront of the Aerospace 3D Printing revolution.

Leave a Comment