Market Growth Projections

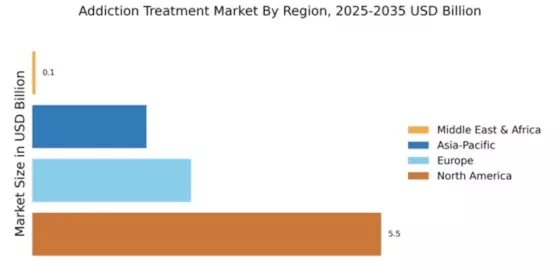

The Global Addiction Treatment Market Industry is poised for substantial growth, with projections indicating a market value of 7.14 USD Billion in 2024 and an anticipated increase to 18.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 9.1% from 2025 to 2035. Such projections highlight the increasing recognition of addiction as a critical public health issue and the corresponding demand for effective treatment solutions. As the market evolves, stakeholders are likely to invest in innovative treatment approaches, further driving market expansion.

Growing Awareness and Education

Awareness and education regarding addiction and its consequences are pivotal drivers of the Global Addiction Treatment Market Industry. Public health campaigns and educational programs are increasingly informing communities about the signs of addiction and available treatment options. This heightened awareness encourages individuals to seek help earlier, thus increasing the demand for treatment services. As more people become educated about addiction, the stigma surrounding it diminishes, leading to a greater willingness to pursue recovery. Consequently, this trend is expected to bolster market growth, as more individuals access treatment services that were previously overlooked.

Advancements in Treatment Modalities

The Global Addiction Treatment Market Industry benefits significantly from advancements in treatment modalities. Innovations in pharmacological therapies, behavioral therapies, and holistic approaches are transforming the landscape of addiction treatment. For example, the introduction of medications that assist in managing withdrawal symptoms and cravings has shown promising results. Furthermore, the integration of technology, such as telehealth services, enhances accessibility for individuals in remote areas. These advancements not only improve treatment outcomes but also attract investments into the sector, thereby contributing to the overall growth of the market. As treatment options diversify, the industry is likely to expand further.

Emerging Trends in Mental Health Integration

The integration of mental health services with addiction treatment is an emerging trend that significantly influences the Global Addiction Treatment Market Industry. Recognizing the co-occurrence of mental health disorders and substance use disorders, treatment providers are increasingly adopting a holistic approach. This integration allows for comprehensive care that addresses both addiction and underlying mental health issues. As a result, treatment programs are evolving to include psychological support alongside traditional addiction therapies. This shift not only enhances recovery outcomes but also expands the market by attracting a broader range of individuals seeking help.

Increased Government Initiatives and Funding

Government initiatives play a crucial role in shaping the Global Addiction Treatment Market Industry. Various countries are implementing policies aimed at reducing the stigma associated with addiction and enhancing access to treatment services. Increased funding for rehabilitation centers and community-based programs is evident, as governments recognize the societal impact of addiction. For instance, national health departments are allocating substantial budgets to support prevention and treatment initiatives. This proactive approach not only fosters a supportive environment for individuals seeking help but also stimulates market growth, as more resources become available for innovative treatment methodologies.

Rising Prevalence of Substance Use Disorders

The Global Addiction Treatment Market Industry experiences a notable increase in demand due to the rising prevalence of substance use disorders. According to government health statistics, millions of individuals worldwide grapple with addiction, prompting a need for effective treatment solutions. This growing concern has led to increased funding and resources allocated towards addiction treatment programs. In 2024, the market is valued at approximately 7.14 USD Billion, reflecting the urgent need for comprehensive treatment options. As awareness of addiction issues expands, the market is likely to see further growth, potentially reaching 18.6 USD Billion by 2035, with a projected CAGR of 9.1% from 2025 to 2035.