Growing Adoption of 5G Technology

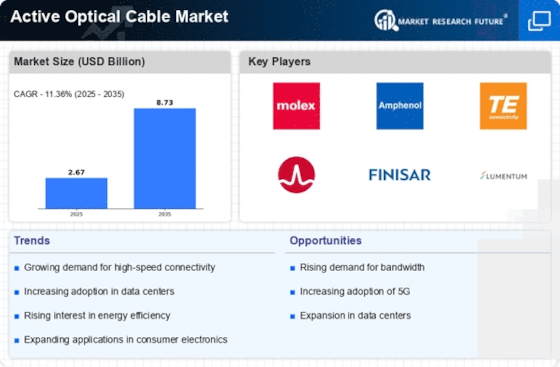

The rollout of 5G technology is poised to have a profound impact on the Active Optical Cable Market. With the increasing demand for faster and more reliable wireless communication, 5G networks necessitate high-capacity backhaul solutions. Active optical cables, known for their ability to transmit data over long distances with minimal signal degradation, are likely to become essential components in the infrastructure supporting 5G networks. As telecommunications companies invest heavily in 5G deployment, the Active Optical Cable Market could see substantial growth. Analysts suggest that the global 5G infrastructure market may exceed 300 billion USD by 2026, indicating a robust opportunity for active optical cable manufacturers to cater to this burgeoning demand.

Increasing Data Center Investments

The Active Optical Cable Market is experiencing a surge in investments directed towards data centers. As organizations increasingly rely on cloud computing and big data analytics, the demand for high-speed data transmission has escalated. In 2025, the data center market is projected to reach a valuation of approximately 200 billion USD, which is likely to drive the adoption of active optical cables. These cables offer superior bandwidth and lower latency compared to traditional copper cables, making them an attractive option for data centers aiming to enhance operational efficiency. Furthermore, the shift towards virtualization and the Internet of Things (IoT) is expected to further propel the Active Optical Cable Market, as these technologies require robust and reliable connectivity solutions.

Expansion of Smart Cities Initiatives

The Active Optical Cable Market is also influenced by the expansion of smart city initiatives worldwide. As urban areas increasingly adopt smart technologies to improve infrastructure and services, the demand for reliable and high-speed connectivity solutions is growing. Active optical cables are well-suited for smart city applications, providing the necessary bandwidth for data-intensive applications such as traffic management, public safety, and environmental monitoring. With investments in smart city projects projected to reach over 1 trillion USD by 2025, the Active Optical Cable Market stands to gain significantly from this trend. The integration of active optical cables into smart city frameworks could enhance communication networks, thereby improving the efficiency and effectiveness of urban services.

Rising Need for High-Performance Computing

The Active Optical Cable Market is benefiting from the increasing need for high-performance computing (HPC) solutions across various sectors. Industries such as finance, healthcare, and scientific research are increasingly adopting HPC to process vast amounts of data efficiently. The Active Optical Cable Market is anticipated to reach around 50 billion USD by 2025, which could significantly boost the demand for active optical cables. These cables facilitate high-speed data transfer between servers and storage systems, thereby enhancing the overall performance of HPC environments. As organizations seek to leverage data analytics and machine learning, the Active Optical Cable Market is likely to experience heightened interest from HPC users looking for reliable and efficient connectivity options.

Emergence of Artificial Intelligence and Machine Learning

The rise of artificial intelligence (AI) and machine learning (ML) technologies is driving the Active Optical Cable Market forward. These technologies require substantial data processing capabilities, which in turn necessitate high-speed data transfer solutions. Active optical cables, with their ability to support high bandwidth and low latency, are becoming increasingly vital in environments where AI and ML applications are deployed. The Active Optical Cable Market is expected to surpass 500 billion USD by 2025, indicating a robust demand for the infrastructure that supports these technologies. As organizations invest in AI-driven solutions, the Active Optical Cable Market is likely to see increased adoption of active optical cables to meet the connectivity demands of advanced computing applications.