Rise of Content Creation

The Action Camera Market is significantly influenced by the rise of content creation across various platforms. With the proliferation of social media and video-sharing sites, individuals are increasingly seeking high-quality equipment to capture their adventures. Action cameras are particularly favored for their portability and durability, making them ideal for vlogging, travel, and extreme sports. Recent statistics indicate that over 70% of content creators utilize action cameras for their projects, highlighting their importance in the digital landscape. This trend is likely to continue as more people engage in content creation, driving demand for innovative features and higher-quality imaging in the Action Camera Market. As a result, brands are focusing on marketing strategies that resonate with this demographic, further propelling market growth.

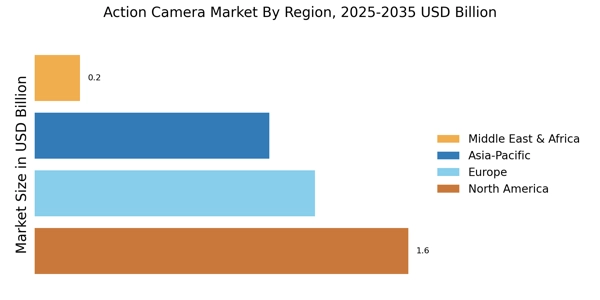

Emerging Markets and Increased Accessibility

The Action Camera Market is experiencing growth in emerging markets, where increased accessibility to technology is driving demand. As disposable incomes rise and technology becomes more affordable, consumers in these regions are increasingly purchasing action cameras for personal use. Recent data suggests that sales in emerging markets have increased by over 25% in the past year, indicating a shift in consumer behavior. This trend is likely to continue as manufacturers expand their distribution channels and offer budget-friendly options. The growing interest in photography and videography among younger demographics further supports this trend, as they seek to document their experiences. As a result, the Action Camera Market is poised for continued expansion in these regions.

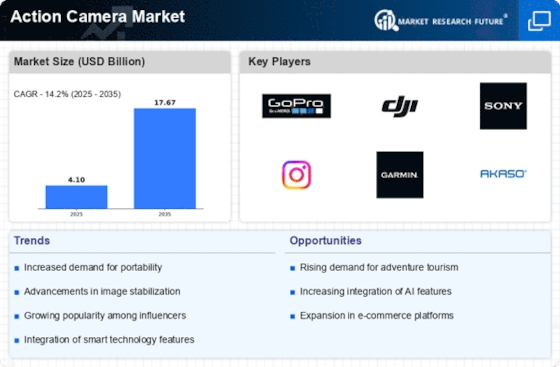

Technological Advancements in Action Cameras

The Action Camera Market is experiencing rapid technological advancements that enhance the functionality and appeal of these devices. Innovations such as 4K video recording, improved image stabilization, and waterproof designs are becoming standard features. The integration of artificial intelligence for automatic scene detection and voice control is also gaining traction. According to recent data, the market for action cameras is projected to grow at a compound annual growth rate of approximately 10% over the next five years. These advancements not only attract professional filmmakers but also appeal to amateur enthusiasts, thereby expanding the consumer base. As technology continues to evolve, manufacturers are likely to invest in research and development to stay competitive, further driving growth in the Action Camera Market.

Growing Interest in Travel and Adventure Tourism

The Action Camera Market is benefiting from the growing interest in travel and adventure tourism. As more individuals seek unique experiences and adventures, the demand for equipment that can capture these moments has surged. Action cameras are particularly appealing due to their compact size and ability to record high-quality video in various settings. Recent surveys indicate that nearly 60% of travelers consider action cameras essential for documenting their journeys. This trend is likely to continue as travel becomes more accessible and adventure tourism gains popularity. Consequently, manufacturers are focusing on creating user-friendly devices that cater to the needs of travelers, thereby driving growth in the Action Camera Market.

Increased Adoption in Sports and Adventure Activities

The Action Camera Market is witnessing increased adoption in sports and adventure activities, as these devices are specifically designed to withstand extreme conditions. Athletes and outdoor enthusiasts utilize action cameras to document their experiences, from surfing to mountain climbing. This trend is supported by data showing that the sports segment accounts for a significant portion of action camera sales, with an estimated 40% of users engaging in outdoor activities. The ability to capture high-definition footage in challenging environments has made action cameras indispensable for sports professionals and amateurs alike. As participation in adventure sports continues to rise, the demand for reliable and high-performance action cameras is expected to grow, further solidifying their position in the Action Camera Market.