Market Analysis

In-depth Analysis of Acoustic Microscope Market Industry Landscape

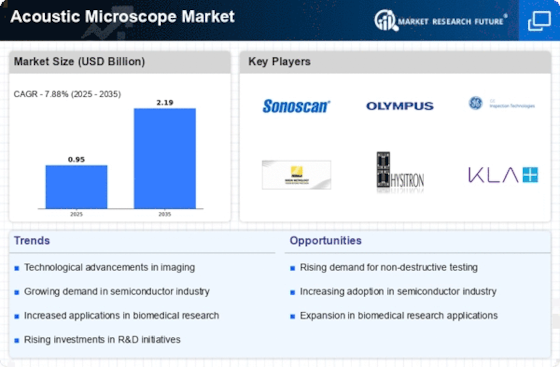

Dynamic and ever-changing market dynamics shape the Acoustic Microscope Market. The ongoing advancement of technology is crucial. Changing materials, transducer technologies, and imaging methods change acoustic microscopy. To address the increased need for high-resolution imaging and inspection capabilities, manufacturers stay ahead of these technical advances. Technology drives market growth and creates a competitive environment where companies compete to produce the most advanced and efficient acoustic microscopes.

Market demand drives the acoustic microscope industry. These tools are needed in electronics, material science, and life sciences. Industries increasingly use acoustic microscopes for non-destructive testing, quality control, and failure analysis. Advanced inspection and imaging technologies are in demand as consumer expectations for product quality and reliability rise. To stay competitive, acoustic microscope companies must understand and meet these changing market demands.

Another major market factor is regulation. Acoustic microscope development and use must comply with healthcare and technology regulations. Manufacturers must monitor regulatory developments and invest in product compliance. Acoustic microscope companies have obstacles and opportunities from regulatory factors that affect product development and market entry.

Market dynamics depend on global economic developments. Economic stability, industrial expansion, and investment conditions affect consumer spending. Industries invest more in innovative technology during economic booms, increasing market expansion. In contrast, economic downturns can limit budgets and market growth. With economic swings, stakeholders must develop resilient strategies to adapt to market changes.

Acoustic microscope market dynamics are competitive. Multiple significant players encourage fierce competition, which drives product innovation and improvement. Market leaders increase market share through aggressive marketing and distribution channel improvements. However, emerging firms use narrow areas and unique solutions to stand out. Competitive dynamics include collaborations and strategic partnerships as organizations seek synergies and complementary qualities to obtain an edge.

Globalization affects market dynamics. Market companies must target foreign markets and build a strong global supply chain. Trade, geopolitics, and international cooperation affect market conditions and opportunities. To adapt to regional market dynamics, companies must strategically position themselves, considering cultural, economic, and legal differences.

Sustainability and environmental concerns are increasingly influencing market dynamics. Acoustic microscopes that meet sustainability criteria are in demand as enterprises pursue green techniques. Energy-efficient technology and green manufacturing are influencing product development and market positioning. Companies that include sustainability can attract eco-conscious customers and acquire a competitive edge."

Leave a Comment