Innovation in Sweetener Blends

The Acesulfame Potassium Market is witnessing a surge in innovation, particularly in the development of sweetener blends. Manufacturers are increasingly combining Acesulfame potassium with other sweeteners to create products that mimic the taste of sugar more closely. This trend is driven by consumer demand for more natural-tasting alternatives to artificial sweeteners. Market data suggests that the segment of blended sweeteners is expected to grow at a CAGR of around 4% in the coming years. This innovation not only enhances the appeal of Acesulfame potassium but also positions it as a versatile ingredient in the Acesulfame Potassium Market, catering to diverse consumer preferences.

Growing Awareness of Diabetes Management

The Acesulfame Potassium Market is also benefiting from the rising awareness surrounding diabetes management. As the prevalence of diabetes continues to escalate, individuals are actively seeking dietary solutions that help manage blood sugar levels. Acesulfame potassium, being a non-nutritive sweetener, does not impact blood glucose levels, making it an attractive option for those with diabetes. Market Research Future indicates that the demand for diabetic-friendly products is expected to grow by approximately 6% annually. This shift in consumer behavior is likely to further enhance the Acesulfame Potassium Market, as more food manufacturers develop products specifically targeting this demographic.

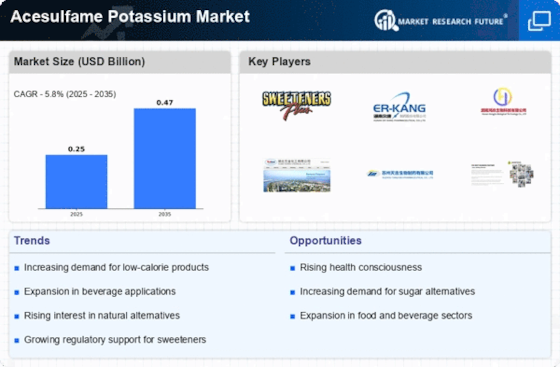

Rising Demand for Low-Calorie Sweeteners

The Acesulfame Potassium Market is experiencing a notable increase in demand for low-calorie sweeteners, driven by a growing awareness of health and wellness among consumers. As obesity rates rise, individuals are seeking alternatives to sugar that do not compromise on taste. Acesulfame potassium, being a zero-calorie sweetener, fits this demand perfectly. Market data indicates that the low-calorie sweetener segment is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This trend is likely to bolster the Acesulfame Potassium Market, as manufacturers incorporate this sweetener into a variety of food and beverage products, including soft drinks, baked goods, and dairy items.

Regulatory Approvals and Safety Assessments

The Acesulfame Potassium Market is positively impacted by the ongoing regulatory approvals and safety assessments conducted by health authorities. Regulatory bodies, such as the Food and Drug Administration (FDA), have recognized Acesulfame potassium as safe for consumption, which has bolstered consumer confidence. This regulatory support is crucial for the market, as it encourages manufacturers to incorporate Acesulfame potassium into their products without hesitation. The approval of Acesulfame potassium for use in various applications has led to an increase in its adoption across multiple sectors, thereby driving growth in the Acesulfame Potassium Market.

Increased Use in Food and Beverage Applications

The Acesulfame Potassium Market is significantly influenced by its extensive application in the food and beverage sector. This sweetener is favored for its stability under heat and its ability to enhance flavor profiles without adding calories. As consumers increasingly opt for healthier food options, manufacturers are reformulating products to include Acesulfame potassium. Recent market analysis suggests that the beverage segment alone accounts for over 40% of the total demand for Acesulfame potassium. This trend indicates a robust growth trajectory for the Acesulfame Potassium Market, as companies strive to meet consumer preferences for low-calorie and sugar-free alternatives.