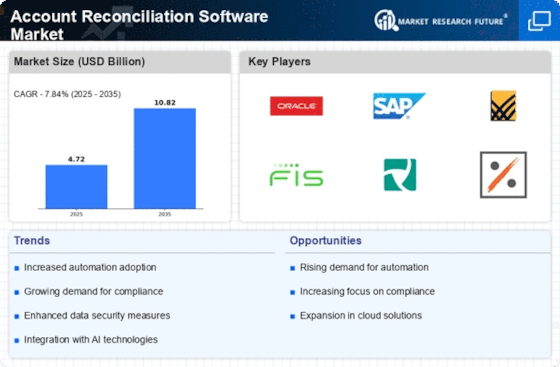

Increasing Demand for Automation

The Account Reconciliation Software Market is experiencing a notable surge in demand for automation solutions. Organizations are increasingly recognizing the efficiency and accuracy that automated reconciliation processes can provide. This shift is driven by the need to reduce manual errors and enhance operational efficiency. According to recent data, the market for automation in financial processes is projected to grow at a compound annual growth rate of approximately 10% over the next five years. As businesses strive to streamline their financial operations, the adoption of account reconciliation software that incorporates automation features is likely to become a standard practice, thereby propelling the growth of the Account Reconciliation Software Market.

Adoption of Cloud-Based Solutions

The Account Reconciliation Software Market is witnessing a significant shift towards cloud-based solutions. Organizations are increasingly adopting cloud technology to enhance accessibility, scalability, and cost-effectiveness in their reconciliation processes. The cloud-based segment of the market is projected to grow at a remarkable rate of 12% annually, driven by the need for real-time data access and collaboration among teams. This trend is particularly appealing to small and medium-sized enterprises that may lack the resources for on-premise solutions. As businesses recognize the advantages of cloud-based account reconciliation software, the market is likely to see a substantial increase in adoption rates, thereby fueling the growth of the Account Reconciliation Software Market.

Focus on Data Analytics and Insights

The Account Reconciliation Software Market is increasingly focusing on data analytics and insights as organizations seek to leverage financial data for strategic decision-making. The integration of advanced analytics capabilities into reconciliation software allows businesses to gain valuable insights into their financial operations. This trend is expected to drive market growth, with analytics-driven solutions projected to account for approximately 15% of the total market by 2026. Companies are recognizing the importance of data-driven decision-making, prompting them to invest in account reconciliation software that not only automates processes but also provides analytical tools for enhanced financial visibility. Consequently, this focus on data analytics is likely to propel the Account Reconciliation Software Market forward.

Expansion of Financial Services Sector

The Account Reconciliation Software Market is poised for growth due to the expansion of the financial services sector. As new financial products and services emerge, the complexity of financial transactions increases, necessitating more sophisticated reconciliation solutions. The financial services sector is anticipated to grow at a rate of 6% per year, creating a substantial demand for account reconciliation software that can handle diverse transaction types and volumes. This growth is likely to encourage financial institutions to invest in advanced reconciliation tools that enhance accuracy and reduce processing times. As a result, the Account Reconciliation Software Market is expected to benefit from this expansion, as organizations seek to optimize their financial operations.

Rising Regulatory Compliance Requirements

The Account Reconciliation Software Market is significantly influenced by the escalating regulatory compliance requirements imposed on financial institutions and corporations. As regulatory bodies continue to enforce stringent guidelines, organizations are compelled to adopt robust reconciliation solutions to ensure compliance. This trend is particularly evident in sectors such as banking and finance, where adherence to regulations is paramount. The market is projected to witness a growth rate of around 8% annually as companies invest in software that not only facilitates reconciliation but also provides comprehensive reporting capabilities to meet compliance standards. Consequently, the demand for account reconciliation software that addresses these regulatory challenges is expected to rise, further driving the Account Reconciliation Software Market.