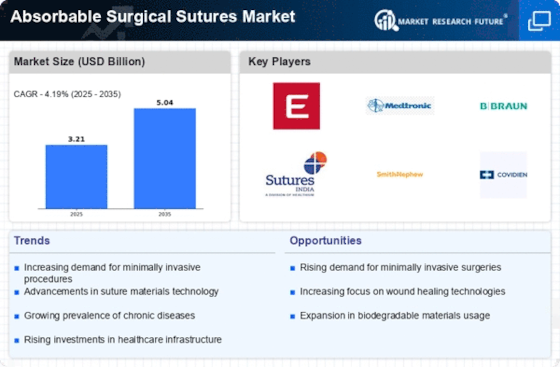

Market Trends

Key Emerging Trends in the Absorbable Surgical Sutures Market

There is an apparent pattern indicating that the number of minimally intrusive surgical techniques is increasing. As the need for less intrusive methods grows, absorbable sutures become essential for inner tissue estimation and conclusion. Sutures that provide a stable outcome during minimally intrusive procedures are met by the market. The market's components are changing as more medical operations are performed globally. The increasing prevalence of chronic illnesses and advances in surgical techniques have led to an increased need for absorbable sutures in several clinical specialties, including general medicine, obstetrics, and gynecology. Absorbable sutures are preferred over non-absorbable ones in certain surgical situations. Sometimes surgeons will use absorbable sutures for interior tissue closure, which are intended to be absorbed by the body over time and reduce the need for stitch evacuation and associated complications. The market is paying more attention to the tissue reactivity and biocompatibility of absorbable sutures. In order to achieve peaceful outcomes, manufacturers aim to provide sutures with the least amount of tissue reactivity, enabling quicker healing and lowering the risk of discomfort or unexpected bodily reactions. The use of antimicrobial coatings on absorbable surgical sutures is clearly a commercial enhancement. The management of surgical site infections is an important postoperative concern that is aided by sutures with antibacterial properties. The combination of antibacterial elements aligns with motivations to improve patient welfare and reduce challenges. Variations in stitch sizes and the need for customization impact the market factors. Specialists frequently need different stitch sizes and thicknesses for various patient situations and methodologies. Manufacturers offer a variety of absorbable stitch options to accommodate varying surgical requirements. Absorbable sutures are increasingly being used in cosmetic and corrective surgery. Resorbable sutures are becoming more and more important for meticulous tissue closure and scar reduction, which contributes to fashionable results in less intrusive restorative medications. The transition to roaming and short-term surgical contemplation settings is a noticeable trend. Absorbable sutures are essential for facilitating convincing, stitch-free twisting recovery in patients who are unlikely to return for stitch evacuation, particularly since more medications are being administered outside of typical clinic settings.

Leave a Comment