Market Analysis

In-depth Analysis of Absorbable Surgical Sutures Market Industry Landscape

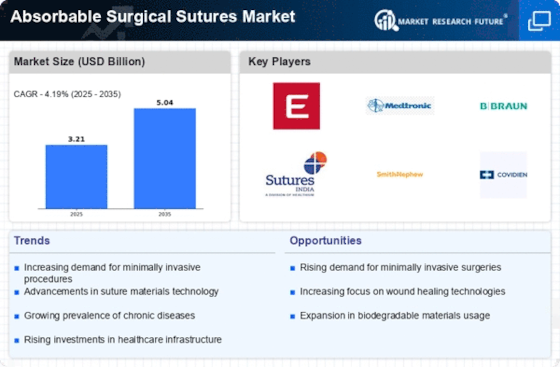

The market factors for absorbable surgical sutures are largely impacted by the overall increase in surgical procedures. The growing interest in absorbable sutures is due to two factors: the increasing use of surgical mediations, such as less intrusive procedures, and the need for sutures to separate normally over time to avoid the need for stitch expulsion. The frequency of chronic illnesses requiring surgical systems has a big impact on market factors. Conditions such as cardiovascular diseases, weight-related problems, and gastrointestinal disorders have led to an expansion in surgical techniques and made absorbable sutures popular across a range of clinical fortes. The market is seeing an increase in the use of short-term and mobile consideration settings. A greater emphasis on same-day procedures has a significant impact on the selection of absorbable sutures, which are more beneficial and effective because they don't require patients to return for stitch removal. Market factors are significantly influenced by absorbable sutures' biocompatibility and reduced provocative reactivity. Improved suture biocompatibility influences market trends by reducing tissue responses, facilitating faster healing from injuries, and promoting long-lasting comfort throughout the healing process. The market is shaped by the increasing use of designed absorbable sutures. Polymers such as polydioxanone (PDO), polylactic corrosive (PLA), and polyglycolic corrosive (PGA) are used in the market, and they affect factors by giving surgeons a range of options that find a balance between tissue strength, retention rates, and similarity. The need for modified absorbable sutures, particularly for surgical strengths, has a significant impact on market factors. Cardiovascular and gynecological procedures set market trends because they require sutures with particular qualities to address the unique requirements and problems of these specialty treatments. The need for more widespread access to surgical care and the problem of disparities in global health have a significant impact on market factors. Increasing the availability of carefully considered absorbable sutures, particularly in low-resource areas, impacts market growth and aligns with global efforts to reduce disparities in medical treatment. Developing courses for experts and other educational activities has a significant impact on market factors. Organizations that operate between surgical centers and stitch manufacturers influence the purchasing habits of consumers by raising awareness of problems, providing advice on the proper use of absorbable sutures, and modifying surgical techniques to improve long-term outcomes. The market is characterized by an increasing emphasis on supportability and environmentally friendly stitch options. Producers of biodegradable materials influence market factors by addressing environmental problems, and providing sutures that are often biodegradable.

Leave a Comment