Sustainability Focus

In the current landscape, the Abrasive Waterjet Cutting Machine Market is increasingly influenced by sustainability initiatives. Waterjet cutting is recognized for its eco-friendly attributes, as it generates minimal waste and does not produce harmful emissions. This aligns with the growing emphasis on sustainable manufacturing practices across industries. Companies are now prioritizing equipment that not only meets production needs but also adheres to environmental regulations. The market is witnessing a shift towards machines that utilize recyclable materials and energy-efficient technologies. As a result, manufacturers are likely to invest in waterjet cutting solutions that contribute to their sustainability goals, potentially leading to a market expansion of around 5% annually.

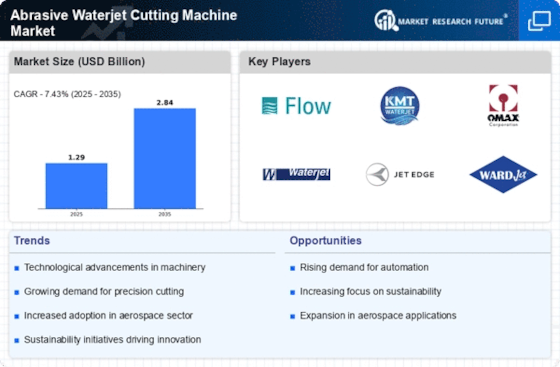

Technological Advancements

The Abrasive Waterjet Cutting Machine Market is experiencing a surge in technological advancements that enhance cutting precision and efficiency. Innovations such as improved nozzle designs and advanced control systems are enabling manufacturers to achieve finer tolerances and faster cutting speeds. For instance, the integration of automation and robotics into waterjet systems is streamlining operations, reducing labor costs, and minimizing human error. According to recent data, the market for waterjet cutting technology is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is largely driven by the demand for high-quality cutting solutions across various sectors, including aerospace, automotive, and metal fabrication.

Customization and Versatility

The demand for customization and versatility in manufacturing processes is a key driver in the Abrasive Waterjet Cutting Machine Market. Waterjet cutting machines are capable of handling a wide range of materials, including metals, glass, and composites, making them suitable for diverse applications. This adaptability allows manufacturers to cater to specific client requirements, enhancing their competitive edge. Furthermore, the ability to create intricate designs and complex geometries without the need for extensive tooling is appealing to industries such as architecture and art. As customization becomes a priority for many businesses, the market for waterjet cutting machines consumables is expected to see a growth trajectory of approximately 6% over the next few years.

Rising Adoption in Metal Fabrication

The metal fabrication industry is witnessing a notable increase in the adoption of abrasive waterjet cutting machines, significantly impacting the Abrasive Waterjet Cutting Machine Market. This trend is driven by the need for high-precision cutting and the ability to work with various metal types, including stainless steel and aluminum. Waterjet cutting offers advantages such as reduced kerf width and minimal heat-affected zones, which are crucial for maintaining material integrity. As manufacturers seek to enhance productivity and reduce waste, the demand for waterjet cutting technology is expected to grow. Recent estimates suggest that the metal fabrication sector could contribute to a market growth rate of approximately 7% in the coming years.

Increased Demand in Aerospace and Automotive Sectors

The aerospace and automotive sectors are significant contributors to the growth of the Abrasive Waterjet Cutting Machine Market. These industries require precise cutting solutions for components that demand high accuracy and quality. Waterjet cutting technology is particularly advantageous for these applications due to its ability to cut through tough materials without altering their properties. As the aerospace industry continues to innovate with lightweight materials and complex designs, the demand for advanced cutting solutions is likely to rise. Similarly, the automotive sector's shift towards electric vehicles and advanced manufacturing techniques is expected to further drive the need for efficient waterjet cutting systems, potentially leading to a market growth of around 8% in these sectors.