Market Analysis

In-depth Analysis of 5G Fixed Wireless Access Market Industry Landscape

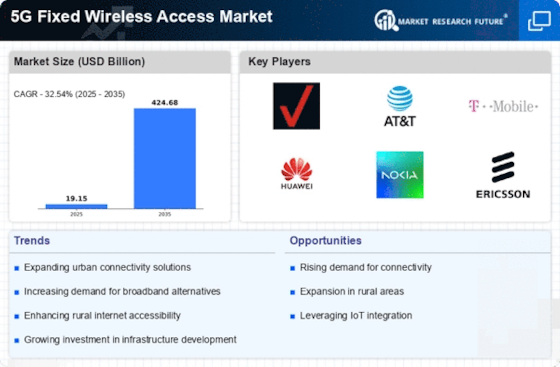

The increasing need for high-speed internet has led to a rapid rise in the 5G Fixed Wireless Access (FWA) market dynamics. Examining the intricate network of variables affecting this industry, we find that customer expectations and technology advancements play a major role. The field of FWA has seen a complete transformation with the advent of 5G technology, which offers lower latency and quicker data transfer rates than conventional broadband options. The unquenchable need for high-speed Internet in both urban and rural regions is a major factor propelling the 5G FWA market. Consumers and companies want quicker and more dependable connections as the digital age advances in order to accommodate a wide range of applications, including online gaming, video streaming, and smart home devices. These criteria can be met by 5G FWA, which provides gigabit-level speeds without requiring a significant amount of physical infrastructure. Furthermore, the competitive environment has a big impact on market dynamics. Internet service providers, telecom operators, and tech firms are vying for the top spot in the 5G FWA market. In the end, customers gain from this competition as it not only promotes innovation but also investment in R&D at competitive rates and superior services. The legislative framework also has a significant impact on how the 5G FWA market is shaped. Globally, governments are formulating regulations to promote the installation of 5G infrastructure, allot spectrum, and expedite approval procedures. In order to guarantee the seamless implementation of 5G FWA networks, these measures will foster cooperation between industry participants and regulatory bodies and create an environment that will support market expansion. However, obstacles like the expense of infrastructure and the complexity of technology prevent the industry from expanding. Installing tiny cells and other network components is just one of the major infrastructure development costs associated with the implementation of 5G FWA. The intricacy of incorporating 5G technology into current networks, which necessitates meticulous design and execution, presents another difficulty for operators. Education and consumers are important factors in the dynamics of the 5G FWA industry. Since 5G FWA is a relatively new technology, there needs to be an effort made to clear up any potential misunderstandings and educate customers about its benefits. The acceptance and comprehension of the technology by end users is just as important to the success of 5G FWA as its technical aspects.

Leave a Comment