Emergence of Smart Cities

The emergence of smart cities represents a transformative trend within the Global 5g Demand and Services Market Industry. As urban areas increasingly adopt smart technologies to improve infrastructure, transportation, and public services, the demand for advanced connectivity solutions becomes critical. 5G networks enable the integration of various smart city applications, such as traffic management systems, environmental monitoring, and public safety initiatives. This integration not only enhances the quality of urban life but also drives economic growth by attracting businesses and residents. The ongoing development of smart cities is expected to significantly contribute to the expansion of the 5G market, as municipalities seek to leverage technology for sustainable urban development.

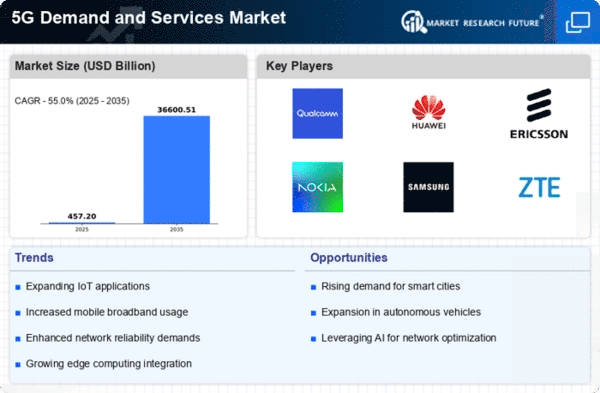

Market Growth Projections

The Global 5g Demand and Services Market Industry is poised for remarkable growth, with projections indicating a substantial increase in market value over the coming years. The market is expected to reach 220.0 USD Billion in 2024, with a staggering forecast of 36647.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 59.21% from 2025 to 2035, reflecting the escalating demand for 5G services across various sectors. As industries continue to adopt 5G technology, the market is likely to expand rapidly, driven by innovations in connectivity and the increasing reliance on digital solutions.

Expansion of IoT Applications

The expansion of Internet of Things (IoT) applications significantly contributes to the growth of the Global 5g Demand and Services Market Industry. With the increasing integration of IoT devices in various sectors, including manufacturing, agriculture, and smart cities, the demand for high-speed, low-latency connectivity is essential. 5G technology facilitates real-time data transmission, enhancing operational efficiency and enabling innovative solutions. As industries adopt IoT solutions, the market is expected to experience substantial growth, with projections indicating a compound annual growth rate of 59.21% from 2025 to 2035. This trend underscores the importance of 5G in supporting the evolving landscape of connected devices.

Increased Mobile Data Consumption

The Global 5g Demand and Services Market Industry is significantly influenced by the increase in mobile data consumption. As consumers engage more with data-intensive applications such as streaming services, online gaming, and augmented reality, the demand for faster mobile networks intensifies. 5G technology addresses this need by offering enhanced bandwidth and reduced latency, thereby improving user experiences. The growing reliance on mobile devices for everyday activities further propels this trend, leading to a projected market value of 36647.3 USD Billion by 2035. This shift in consumer behavior underscores the necessity for robust 5G infrastructure to support the burgeoning demand for mobile data.

Government Initiatives and Investments

Government initiatives and investments play a pivotal role in shaping the Global 5g Demand and Services Market Industry. Many governments worldwide are prioritizing the rollout of 5G infrastructure to enhance national competitiveness and drive economic growth. These initiatives often include funding for research and development, as well as partnerships with private sector stakeholders to accelerate deployment. For instance, various countries are establishing regulatory frameworks that facilitate the swift implementation of 5G networks. Such proactive measures are likely to bolster market growth, as they create an environment conducive to innovation and attract investments in 5G technologies.

Rising Demand for High-Speed Connectivity

The Global 5g Demand and Services Market Industry is witnessing an unprecedented surge in demand for high-speed connectivity. As businesses and consumers increasingly rely on digital services, the need for faster and more reliable internet access becomes paramount. In 2024, the market is projected to reach 220.0 USD Billion, driven by the proliferation of smart devices and the Internet of Things. This demand is further fueled by advancements in technology, which enable seamless connectivity across various sectors, including healthcare, automotive, and entertainment. The shift towards remote work and online services necessitates robust infrastructure, positioning 5G as a critical enabler of digital transformation.