Top Industry Leaders in the 5G Customer Premises Equipment Market

The Competitive Landscape of the 5G Customer Premises Equipment Market

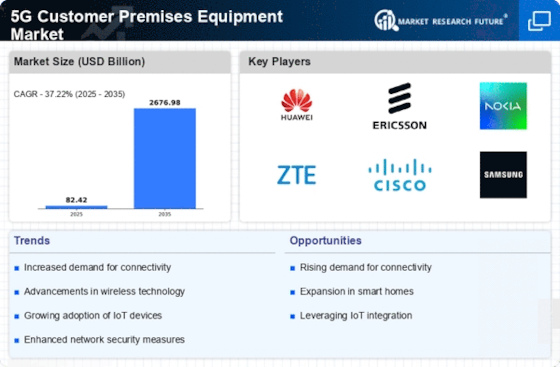

The 5G Customer Premises Equipment (CPE) market is experiencing explosive growth, fueled by the rapid rollout of 5G networks and rising consumer demand for high-speed, low-latency connectivity. This dynamic landscape is marked by intense competition, with established players battling it out against nimble newcomers. Understanding the key players, their adopted strategies, and the evolving competitive scenario is crucial for navigating this dynamic market.

Key Player:

- Ericsson

- Fujitsu

- Huawei Technologies Co., Ltd.

- Xiamen Yeastar Information Technology Co., Ltd.

- Askey Computer Corp

- NETGEAR

- Inseego Corp.

- Sercomm Corporation

- WAVETEL TECHNOLOGY

Strategies Adopted by Key Players:

- Product Innovation: Continuous development of new and advanced 5G CPE devices with enhanced features, higher speeds, and improved efficiency is crucial.

- Strategic Partnerships: Collaborations with carriers, chipset manufacturers, and content providers can create integrated solutions and expand market reach.

- Market Segmentation: Targeting specific user segments with tailored products and pricing strategies can address diverse needs and preferences.

- Cost Optimization: Streamlining production processes and leveraging economies of scale are essential for maintaining competitiveness in a price-sensitive market.

- Focus on Emerging Markets: Expanding into developing regions with growing 5G adoption offers significant growth potential.

Factors Influencing Market Share Analysis:

- Product Portfolio: The breadth and depth of a company's product offerings, catering to various segments like fixed wireless access (FWA), mobile hotspots, and enterprise gateways, significantly impacts its market share.

- Technological Innovation: Companies that stay ahead of the curve by investing in R&D and incorporating advanced technologies like millimeter wave (mmWave) and network slicing gain a competitive edge.

- Pricing Strategy: Offering competitive pricing while maintaining product quality is crucial for attracting price-sensitive consumers and securing operator partnerships.

- Distribution Channels: Building strong relationships with carriers, retailers, and online marketplaces is essential for reaching a wider audience and boosting sales.

- Brand Recognition and Reputation: Established brands with a strong reputation for quality and reliability enjoy a significant advantage in attracting customers.

Emerging Companies and Technologies:

- Focus on niche segments: Companies are increasingly targeting specific segments like gaming, AR/VR, and industrial applications with specialized CPE solutions.

- Software-defined CPE (SD-CPE): The adoption of SD-CPE allows for greater flexibility, scalability, and management of CPE devices, opening up new opportunities for innovative players.

- Open-source platforms: Open-source platforms like OpenWrt are enabling smaller companies to develop and customize CPE solutions at a faster pace.

Latest Company Updates:

Ericsson:

- October 2023: Ericsson launched the NGM8000 fixed wireless access (FWA) gateway, a high-performance 5G CPE solution designed for homes and businesses.

- September 2023: Ericsson partnered with Deutsche Telekom to deploy a 5G standalone (SA) network in Germany, which will utilize Ericsson's 5G CPE solutions.

- July 2023: Ericsson announced a collaboration with Qualcomm Technologies to develop advanced 5G CPE solutions with improved performance and power efficiency.

Fujitsu:

- October 2023: Fujitsu launched the 5G WINNABLE FX, a new series of 5G CPE devices for homes and businesses. The WINNABLE FX series features high-speed data transfer rates and low latency.

- July 2023: Fujitsu partnered with NTT Docomo to deploy a 5G standalone (SA) network in Japan, which will utilize Fujitsu's 5G CPE solutions.

- June 2023: Fujitsu announced the development of a new AI-powered 5G CPE solution that can optimize network performance and improve user experience.