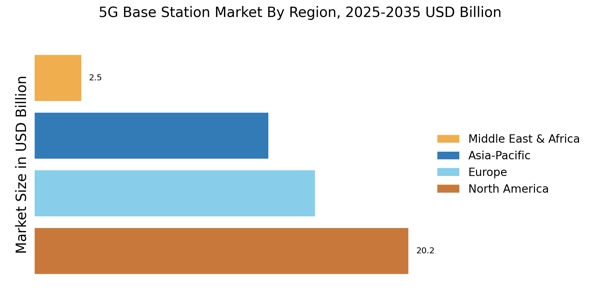

By region, the study segments the market into North America, Europe, Asia-Pacific, and the Rest of the World. During the projected period, Asia-Pacific is the most significant revenue contributor to the 5G base station market. The rising numbers of mobile subscribers have set the foundation for success in 5G Industrial IoT development. Additionally, the Government of China views 5G development as crucial to the country’s development in the technology sector and its economy.

The government has majority control over all three of the country’s mobile operators (China Mobile, China Telecom, and China Unicom), with its guidance of 5G network deployments, China has stayed ahead of the competition infrastructure in terms of research & development in 5G technology. While North America holds the second largest market share.

The region is well known for its high adoption rate of new advanced technologies, including the Internet of Things (IoT), wearable technology, and autonomous or connected cars. A reliable and fast connection required for these technologies is expected to be addressed by 5G. In North America, with 5G expected to deliver many years of value to consumers and enterprises in the foreseeable future, various projects such as ‘Next G’ activities are primarily centered around academia with additional efforts from agencies of the US government and SDOs (Standard Developing Organizations).

These entities, through public-private partnerships, are actively engaging in scientific and applied research in emerging technologies. Therefore, North America is expected to maintain its leadership in new technologies that will underpin 5G technology.

Figure 3: BASE STATION MARKET SHARE BY REGION (2021-2030)

January 2021 Cisco launched a new Catalyst router for 5G cellular gateway and Catalyst 8000-series edge platform, encompassing routing, SD-WAN, security, computer, and other functionalities through the use of virtual network functions (VNFs).

The countries considered in the scope of 5G base station market are US, Canada, Mexico, UK, Germany, France, Italy, Spain, Switzerland, Austria, Belgium, Denmark, Finland, Greece, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Sweden, Romania, Ireland, China, Japan, Singapore, Malaysia, Indonesia, Philippines, South Korea, Hong Kong, Macau, Singapore, Brunei, India, Australia & New Zealand, South Africa, Egypt, Nigeria, Saudi Arabia, Qatar, United Arab Emirates, Bahrain, Kuwait, and Oman, Brazil, Argentina, Chile, and others.