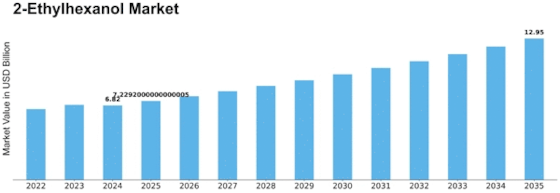

2 Ethylhexanol Size

2-Ethylhexanol Market Growth Projections and Opportunities

The 2-Ethylhexanol market is influenced by various market factors that play a pivotal role in shaping its dynamics. One of the primary factors impacting this market is the growing demand from end-use industries such as plasticizers, coatings, and adhesives. As a key ingredient in the production of plasticizers, 2-Ethylhexanol is extensively used in the manufacturing of PVC, contributing to the burgeoning construction and automotive sectors. This increasing demand is a direct consequence of urbanization and infrastructure development, particularly in emerging economies.

2-Ethylhexanol Market Size was valued at USD 5.1 Billion in 2022. The 2-Ethylhexanol industry is projected to grow from USD 6.3 Billion in 2023 to USD 11 Billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6.00%

Moreover, the 2-Ethylhexanol market is also influenced by factors related to the raw material supply chain. The availability and cost of raw materials, such as n-butyraldehyde and propylene, significantly impact the overall production cost of 2-Ethylhexanol. Any fluctuations in the prices or availability of these raw materials can lead to variations in the cost of production, subsequently affecting the pricing strategies adopted by market players.

Global economic conditions also play a vital role in shaping the 2-Ethylhexanol market. Economic downturns or uncertainties can impact the overall demand for end-use products, leading to fluctuations in the consumption of 2-Ethylhexanol. On the other hand, a growing global economy often results in increased industrial activities and infrastructure projects, fostering the demand for 2-Ethylhexanol.

Environmental regulations and sustainability concerns are becoming increasingly influential in the 2-Ethylhexanol market. Governments and regulatory bodies worldwide are implementing stringent environmental norms, prompting manufacturers to develop eco-friendly production processes and products. The 2-Ethylhexanol market is witnessing a shift towards bio-based alternatives, driven by the need to reduce the environmental impact of chemical manufacturing.

Furthermore, technological advancements in the production processes of 2-Ethylhexanol contribute to market dynamics. Continuous research and development efforts aim at enhancing the efficiency and sustainability of production methods, ensuring cost-effectiveness and environmental compliance. Innovations in catalysts and process optimization play a crucial role in shaping the competitive landscape of the 2-Ethylhexanol market.

Geopolitical factors, including trade relations and political stability, also influence the 2-Ethylhexanol market. Trade tensions between major economies can impact the global supply chain, affecting the pricing and availability of 2-Ethylhexanol. Additionally, geopolitical instability in key manufacturing regions can disrupt the production and distribution of 2-Ethylhexanol, causing market fluctuations.

Market competition is a constant factor in the 2-Ethylhexanol industry. The presence of multiple manufacturers, each striving to gain a competitive edge, results in innovations, improved product quality, and competitive pricing strategies. Strategic collaborations, mergers, and acquisitions also contribute to the overall market landscape, influencing the market dynamics of 2-Ethylhexanol.

In conclusion, the 2-Ethylhexanol market is subject to a myriad of factors that collectively shape its trajectory. From the demand in end-use industries to raw material availability, economic conditions, environmental regulations, technological advancements, geopolitical factors, and market competition, each factor plays a crucial role in determining the growth and stability of the 2-Ethylhexanol market. Manufacturers and stakeholders in this industry need to remain vigilant and adaptable to navigate the evolving landscape and capitalize on emerging opportunities.

Leave a Comment