Regulatory Compliance

Stringent regulations regarding energy efficiency and environmental sustainability are driving growth in the Industrial Lighting Market Industry. Governments worldwide are implementing policies that mandate the use of energy-efficient lighting solutions in industrial settings. For example, the European Union has set ambitious targets for reducing carbon emissions, which has led to increased adoption of energy-efficient lighting technologies. Compliance with these regulations not only helps industries avoid penalties but also enhances their corporate social responsibility profiles. This regulatory push is expected to contribute to the market's expansion, with projections indicating a rise to 20.5 USD Billion by 2035.

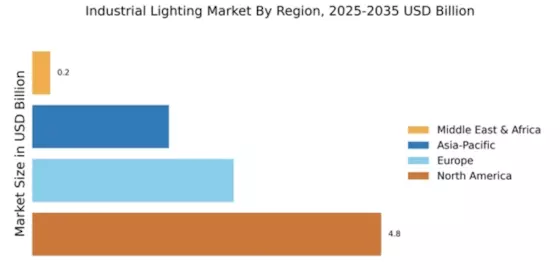

Market Growth Projections

The Industrial Lighting Industry is poised for substantial growth, with projections indicating a market size of 9.7 USD Billion in 2024 and an anticipated increase to 20.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 7.02% from 2025 to 2035. The expansion is driven by various factors, including technological advancements, regulatory compliance, and the rising demand for energy-efficient solutions. As industries continue to evolve and adapt to new challenges, the market is likely to witness significant transformations, reflecting the dynamic nature of industrial lighting.

Technological Advancements

The Industrial Lighting Industry is experiencing a surge in demand due to rapid technological advancements. Innovations such as LED lighting and smart lighting systems are transforming traditional industrial lighting solutions. These technologies offer enhanced energy efficiency, longer lifespans, and reduced maintenance costs. For instance, LED lighting can consume up to 75% less energy than conventional incandescent bulbs, which significantly lowers operational costs. As industries increasingly adopt these technologies, the market is projected to reach 9.7 USD Billion in 2024, reflecting a growing preference for sustainable and cost-effective lighting solutions.

Increased Industrial Automation

The ongoing trend of industrial automation is significantly influencing the Industrial Lighting Market. As factories and manufacturing plants increasingly integrate automated systems, the need for advanced lighting solutions that can adapt to varying operational conditions becomes paramount. Automated lighting systems can optimize energy consumption by adjusting brightness based on occupancy and activity levels. This adaptability not only enhances workplace safety but also contributes to energy savings. The integration of automation in industrial processes is likely to propel the market forward, aligning with the projected CAGR of 7.02% from 2025 to 2035.

Rising Demand for Energy Efficiency

A growing emphasis on energy efficiency is reshaping the Industrial Lighting Industry. Industries are under pressure to reduce energy consumption and lower operational costs, leading to a shift towards energy-efficient lighting solutions. The adoption of technologies such as LED and smart lighting systems is becoming increasingly prevalent, as these solutions offer substantial energy savings. For instance, transitioning to LED lighting can result in energy savings of up to 80% compared to traditional lighting options. This shift not only supports sustainability goals but also aligns with the market's anticipated growth trajectory, reaching 9.7 USD Billion in 2024.

Global Expansion of Manufacturing Facilities

The expansion of manufacturing facilities across emerging economies is a key driver of the Global Industrial Lighting Market Industry. As countries like India and China continue to develop their industrial sectors, the demand for efficient and effective lighting solutions is on the rise. New manufacturing plants require modern lighting systems that enhance productivity and safety. This trend is particularly evident in sectors such as automotive and electronics, where high-quality lighting is essential for operational efficiency. The influx of new facilities is expected to contribute to the market's growth, with projections indicating a rise to 20.5 USD Billion by 2035.