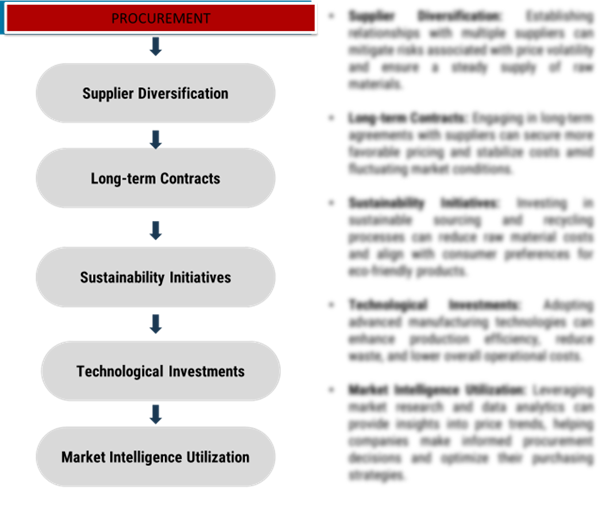

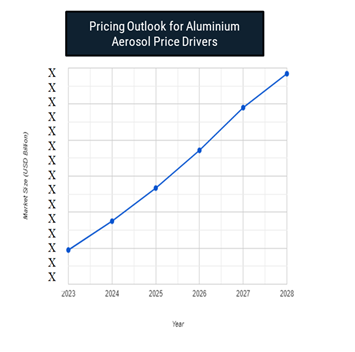

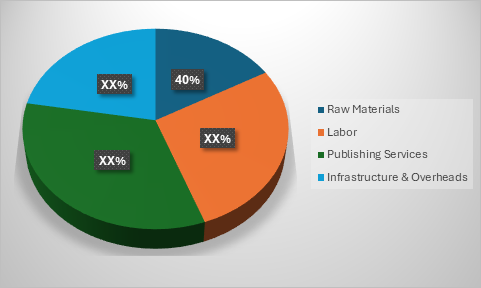

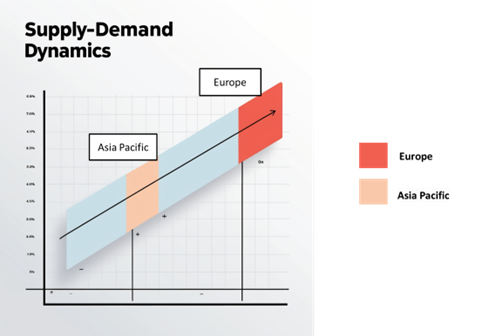

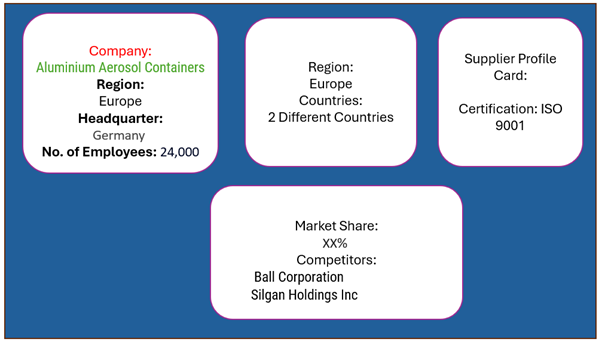

The pricing dynamics of aluminium aerosol cans are influenced by multiple market drivers, including raw material costs, technological advancements in manufacturing, and the demand from industries such as personal care, healthcare, and food & beverage. A surge in raw aluminium prices, driven by fluctuations in supply and demand as well as geopolitical factors, is a primary driver impacting production costs. Furthermore, the adoption of more sustainable and lightweight designs is pushing companies to invest in innovative production methods, potentially increasing upfront costs but improving long-term efficiency. Additionally, consumer preference for recyclable packaging and increasing environmental regulations are shaping pricing by encouraging eco-friendly manufacturing practices and materials. This report delves into these price drivers, analysing the influence of raw materials, environmental policies, and technology advancements, while highlighting trends in procurement strategies that can mitigate price volatility. The market outlook for aluminium aerosol cans is strong, with several key trends indicating steady growth through 2032: Growth Rate:4.40% Key Trends and Sustainability Outlook: Growth Drivers: Overview of Market Intelligence Services for the Aluminium Aerosol Can Price Drivers Market Recent analyses highlight that the aluminium market faces challenges due to fluctuating raw material costs, energy expenses, and environmental regulations. Market reports provide detailed cost projections and insights into procurement strategies, helping companies manage price variations while ensuring sustainable operations. By leveraging these insights, stakeholders can adopt cost-saving measures, optimize supply chains, and maintain efficiency in a competitive and evolving market. Procurement Intelligence for Aluminium Aerosol Can Price Drivers: Category Management and Strategic Sourcing To remain competitive in the aluminium aerosol can market, businesses are optimizing procurement strategies using cost tracking tools to monitor supplier expenses and enhance supply chain performance with market intelligence. Strategic sourcing and effective category management are crucial for cost-efficient procurement and ensuring a consistent supply of aluminium aerosol cans. Pricing Outlook for Aluminium Aerosol Price Drivers: Spend Analysis The pricing for aluminium aerosol cans is anticipated to experience moderate fluctuations due to various market dynamics. Factors such as rising raw material costs, particularly for aluminium, and increasing demand for sustainable packaging are expected to exert upward pressure on prices. Additionally, operational costs linked to production and logistics are likely to impact overall pricing strategies. Graph shows general upward trend pricing for aluminium aerosol price drivers and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic. The aluminium aerosol can market is forecasted to see gradual growth in pricing over the coming years, driven by increased demand across personal care, household, and pharmaceutical sectors. Supply chain disruptions and fluctuations in production costs will contribute to pricing challenges. However, advancements in recycling technologies and greater use of recycled materials can help stabilize costs. Manufacturers are focusing on optimizing their supply chains and forging strategic partnerships to manage expenses effectively, ensuring competitive pricing while meeting consumer demands for eco-friendly solutions. Cost Breakdown for the Aluminium Aerosol Can Price DriversTotal Cost of Ownership (TCO) and Cost Saving Opportunities: Cost Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies In the aluminium aerosol can market, optimizing procurement strategies can lead to significant cost savings and improve operational efficiency. Collaborative partnerships among manufacturers can facilitate shared resources and pooled purchasing power, effectively lowering individual costs. The adoption of innovative manufacturing technologies can enhance production efficiency while reducing material waste. Implementing sustainable practices in the supply chain can minimize raw material costs and attract environmentally conscious consumers. Furthermore, leveraging digital tools for inventory management helps streamline operations and reduce excess stock. Strategic sourcing of raw materials and exploring alternative suppliers can mitigate price volatility, while energy-efficient production methods can lower utility expenses. Overall, these procurement strategies empower aluminium aerosol can manufacturers to enhance their market competitiveness while effectively managing costs. Supply and Demand Overview for Aluminium Aerosol Can Price Drivers: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) The aluminium aerosol can market is witnessing strong growth due to rising demand in personal care, pharmaceuticals, and household product sectors. This demand is further fueled by advancements in manufacturing technologies and increasing consumer preference for sustainable and recyclable packaging solutions. Demand Factors: Supply Factors: Regional Demand-Supply Outlook: Aluminium Aerosol Price Drivers: The Image shows growing demand for Aluminium Aerosol Can Price Drivers in both Europe and Asia, with potential price increases and increased Competition. Europe: Dominance in Aluminium Aerosol Price Drivers. Europe, particularly countries like Germany, France is witnessing a significant growth trajectory in the aluminium aerosol market characterized by: Europe Remains a key hub aluminum aerosol can price drivers Innovation and Growth. Supplier Landscape: Supplier Negotiations and Strategies The aluminium aerosol can market features a diverse supplier landscape, with both global and regional manufacturers contributing to market dynamics. Suppliers play a critical role in shaping pricing, technological advancements, and product availability. The market remains competitive, driven by established players and emerging firms focusing on sustainable packaging innovations. Currently, consolidation among leading suppliers is prominent, with major manufacturers holding significant market share. Meanwhile, smaller firms are gaining traction by emphasizing customized solutions and environmentally friendly practices. Some key suppliers in the aluminium aerosol can market include: Key Developments Procurement Category Significant Development: Aluminium Aerosol Can Price Drivers Attribute/Metric Details Market Sizing Global aluminium market is expected to reach approximately 65.6 billion by 2032, driven by a compound annual growth rate (CAGR) of around 4.40% from 2024 to 2032. Aluminium Aerosol Can Price Drivers Technology Adoption Rate Approximately 50% of manufacturers are adopting advanced production technologies for efficiency and precision. Top Aluminium Aerosol Can Price Drivers Strategies for 2024 Focus on lightweighting, sustainability, cost optimization, and enhanced product designs. Aluminium Aerosol Can Price Drivers Process Automation Nearly 40% of companies have automated manufacturing processes to improve production efficiency. Aluminium Aerosol Can Price Drivers Process Challenges Key challenges include fluctuating raw material prices, energy costs, and sustainability requirements. Key Suppliers Prominent players include Ball Corporation, CCL Container, Crown Holdings, Ardagh Group, and Exalt Corporation. Key Regions Covered North America, Europe, and Asia-Pacific, with key markets in the U.S., China, Germany, and India due to high demand and production capacities. Market Drivers and Trends Growth is driven by increasing demand for personal care and household products, sustainable packaging trends, and innovation in design and functionality.Aluminium Aerosol Can Price Drivers Market Overview:

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide insights into cost components like raw materials, energy, and logistics, along with supplier performance evaluations and market trends to support cost-effective sourcing.

We evaluate TCO by considering raw material prices, manufacturing costs, transportation, and supplier margins, offering a complete understanding of long-term procurement expenses.

Our risk management solutions focus on mitigating supply chain disruptions, addressing raw material price volatility, and ensuring supplier reliability through data-driven insights.

We provide Supplier Relationship Management (SRM) strategies, emphasizing collaboration, flexible contract terms, and quality assurance for long-term partnerships.

Our recommendations include competitive supplier selection, effective pricing negotiations, and sustainable sourcing practices to ensure efficient procurement.

By leveraging automation and analytics, digital transformation enhances supplier performance tracking, market forecasting, and procurement efficiency.

Supplier performance management ensures adherence to quality standards, timely deliveries, and cost optimization, supporting better decision-making.

Our insights help secure favourable pricing, volume discounts, and flexible payment terms through data-backed negotiation strategies.

We provide market analysis tools that highlight global price trends, cost drivers, and supplier market shares for informed procurement decisions.

We assist in evaluating suppliers' adherence to environmental, safety, and industry standards to maintain compliance.

We offer solutions like diversified sourcing and contingency planning to minimize the impact of supply chain disruptions.

Our tools enable tracking of supplier quality, delivery consistency, and compliance metrics to improve procurement efficiency.

We help identify suppliers implementing sustainable practices, ensuring minimal environmental impact and ethical sourcing.

Our pricing analysis compares supplier costs, identifies negotiation levers, and evaluates market conditions to secure the best value.

Table of Contents (TOC)

1. Executive Summary: Market Overview, Procurement Insights, and Negotiation Leverage

• Aluminium Aerosol Can Price Drivers Market Overview

• Key Highlights

• Supply Market Outlook

• Demand Market Outlook

• Category Strategy Recommendations

• Category Opportunities and Risks

• Negotiation Leverage and Key Talking Points

• Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

2. Research Methodology: Procurement Intelligence, Market Analysis, and Spend Analysis

Tools

• Definition and Scope

• Research Objectives for the Aluminium Aerosol Can Price Drivers Market

• Data Sources and Approach

• Assumptions and Limitations

• Market Size Estimation and Forecast Methodology

3. Market Analysis and Category Intelligence

• Market Maturity and Trends

• Industry Outlook and Key Developments

• Drivers, Constraints, and Opportunities

• Regional Market Outlook within the Aluminium Aerosol Can Price Drivers Market

• Procurement-Centric Five Forces Analysis

• Mergers and Acquisitions (M&As)

• Market Events and Innovations

4. Cost Analysis, Spend Analysis, and Pricing Insights

• Cost Structure Analysis

• Cost Drivers and Savings Opportunities

• Total Cost of Ownership (TCO) Analysis

• Pricing Analysis and Expected Savings

• Billing Rate Benchmarking

• Factors Influencing Pricing Dynamics

• Contract Pointers and SLAs

• Market Cost Performance Indicators

• Risk Assessment and Mitigation Strategies

• Spend Analytics and Cost Optimization

5. Supplier Analysis and Benchmarking

• Aluminium Aerosol Can Price Drivers Supply Market Outlook

• Supply Categorization and Market Share

• Aluminium Aerosol Can Price Drivers Market Supplier Profiles and SWOT Analysis

• Supplier Performance Benchmarking

• Supplier Performance Evaluation Metrics

• Disruptions in the Supply Market

6. Technology Trends and Innovations

• Current Industry Technology Trends

• Technological Requirements and Standards

• Impact of Digital Transformation

• Emerging Tools and Solutions

• Adoption of Standardized Industry Practices

7. Procurement Best Practices

• Sourcing Models and Strategies

• Pricing Models and Contracting Best Practices

• SLAs and Key Performance Indicators (KPIs)

• Strategic Sourcing and Supplier Negotiation Tactics

• Industry Sourcing Adoption and Benchmarks

8. Sustainability and Risk Management: Best Sustainability Practices

• Supply Chain Sustainability Assessments

• Corporate Social Responsibility (CSR) Alignment

• Risk Identification and Assessment

• Contingency Planning and Supplier Diversification

• Holistic Risk Mitigation Strategies

9. Category Strategy and Strategic Recommendations

• Market Entry Strategies

• Growth Strategies for Market Expansion

• Optimal Sourcing Strategy

• Investment Opportunities and Risk Analysis

• Supplier Innovation Scouting and Trends

• Cross-Functional Collaboration Frameworks

10. Future Market Outlook

• Emerging Market Opportunities

• Predictions for the Next Decade

• Expert Opinions and Industry Insights

11. Appendices: Procurement Glossary, Abbreviations, and Data Sources

• Glossary of Terms

• Abbreviations

• List of Figures and Tables

• References and Data Sources