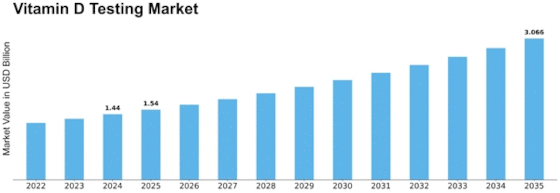

Vitamin D Testing Size

Vitamin D Testing Market Growth Projections and Opportunities

Vitamin D testing is gaining popularity in the marketplace since people are becoming more educated regarding how widespread vitamins can be deficiency. People realize the importance of proper amounts of vitamin D to be healthy, which is why testing an individual’s status for this nutrient becomes necessary. The increase in disorders such as rickets, osteoporosis and other bone related illnesses that are due to vitamin D deficiency is affecting Vitamin D testing. As noted by healthcare experts, routine testing enables prompt detection and treatment of vitamin D deficiency or insufficiency. With a worldwide maturing populace, there is a developing spotlight on bone wellbeing, as vitamin D assumes a urgent part in calcium retention and bone digestion. The elderly are especially helpless against vitamin D deficiency, adding to the extension of the Vitamin D Testing market. Constant sicknesses, including diabetes, cardiovascular diseases, and immune system disorders, are associated with an increased gamble of vitamin D deficiency. As awareness of these connections develops, doctors are integrating vitamin D testing into routine diagnostic conventions, driving market demand. The significance of vitamin D in pregnancy and pediatric care is impacting the Vitamin D Testing market. Testing during pregnancy surveys maternal vitamin D status, affecting fetal development, while paediatricians regularly screen vitamin D levels in babies and children to help appropriate bone development. Geographic variables and occasional varieties in daylight openness add to varieties in vitamin D levels. In locales with limited daylight, individuals might be more inclined to deficiency, requiring standard testing. Occasional vacillations influence market dynamics as testing rates might increment during cold weather a very long time with reduced daylight. The shift towards preventive healthcare is helping the Vitamin D Testing market. Individuals are progressively proactive about their wellbeing, looking for vitamin D testing as a feature of standard check-ups to identify and address deficiencies before they grow into more extreme medical problems. The broader wellbeing and health trends are affecting the Vitamin D Testing market. Individuals engaged in wellness and wellbeing exercises are bound to screen their vitamin D levels as a component of an all-encompassing way to deal with wellbeing, adding to increased testing rates. The rise of telehealth and direct-to-purchaser testing administrations is influencing the Vitamin D Testing market. With the comfort of at-home testing units and online meetings, individuals can undoubtedly get to vitamin D testing, leading to a broader reach and increased market infiltration.

Leave a Comment