Market Analysis

In-depth Analysis of US C arms Market Industry Landscape

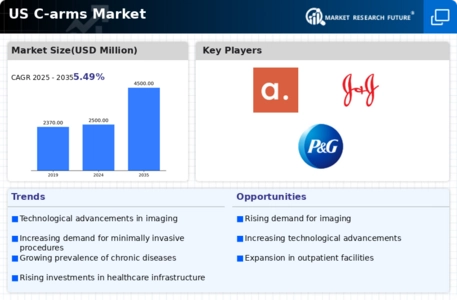

The market dynamics of the U.S. C-arms market are shaped by a combination of factors that influence supply and demand, competition, and overall industry growth. C-arms, a crucial imaging technology used in various medical procedures, including orthopedic, cardiovascular, and gastrointestinal interventions, have witnessed a steady rise in demand in the U.S. healthcare sector. The other key factor in market dymanics is technological progress. Innovative manufacturers in the C-arms industry continue to develop new marketing features and functionalities to address the growing need of healthcare providers to acquire the newest imaging technology. There is a strong tendency for these developments to provide better image quality, more mobility options, and less radiation exposure that can, along with the increased precision and safety, contribute to the benefits provided to the patients. However, emerging trends are also the increasing rate of chronic diseases together with aging population. With the demographic transformation that the United States is facing along the lines of a rapidly aging population, this also manifests to the demand for C-arm medical imaging techniques in procedures such as joint replacement operations and vascular interventions. The shifting demographics, in turn, play an essential role in the increasing demand for c-arms’ market. Along with governmental regulations and reimbursement policies, market dynamics are also shaped by market dynamics, utility efficacy and the ability to personalize care. While tighter regulatory standards in the healthcare sector are causing difficulties for the developers, manufacturers, and distributors of C-arm systems, these are also ensuring innovations in the devices and better health outcomes for patients. Similarly, the payment system rules will impact healthcare providers' choices to commit resources towards GCA technologies, as the financial consideration will be the heart of acquiring cutting-edge medical equipments. In addition to this, the parameters of competitiveness changes with each newcomer having a motive to gain a competitive edge that makes the market more aggressive. Companies invest in researches and development that has proven to be a key in surpassing the competition, by developing unique features and meeting specific needs of the market. This competition is a creative stadium around which innovations are born and C-arm technology keeps improving.

The COVID-19 pandemic has introduced additional dynamics to the U.S. C-arms market. The increased focus on respiratory care and the need for efficient diagnostic tools during the pandemic have accelerated the demand for mobile C-arms. These portable imaging solutions provide flexibility and versatility, allowing healthcare providers to adapt to dynamic situations and emerging healthcare challenges.

Leave a Comment