Market Share

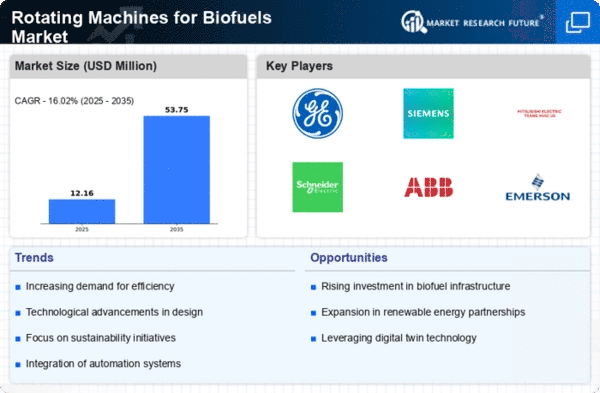

Rotating Machines for Biofuels Market Share Analysis

On the basis of Production Process, the global rotating machines for biofuels market is segmented as transesterification, gasification, fermentation, and others.

Transesterification accounted for the largest market share of 36.34% in 2018, with a market value of USD 364.8 million; the market is expected to register the highest CAGR of 7.72% during the forecast period. Gasification was the second-largest market in 2018, valued at USD 315.8 million; the market is projected to exhibit a CAGR of 6.74%.

The transesterification process is a method of biofuel production in which vegetable oils, animal fats, or waste cooking oils are used to produce conventional biodiesel. This process converts oils and fats into biodiesel and glycerine. In the transesterification process, a glyceride reacts with an alcohol (typically methanol or ethanol) in the presence of a catalyst forming fatty acid alkyl esters and alcohol to produce biodiesel eventually.

Biomass gasification is considered to be the most promising technology for the generation of electricity from biomass sources. It is a mature technology used to convert biomass sources through a controlled process that involves heat, steam, and oxygen to convert biomass to hydrogen and other fuels without combustion that can be further used for generating power. The growth of the segments is due to its advantages over other combustion processes for the generation of biomass power, as the gasification plants reportedly produce significantly lower quantities of air pollutants over other combustion process plants.

During fermentation, microorganisms such as bacteria and yeast metabolize plant sugars and produce ethanol. Ethanol fermentation by yeast is the most widely used process. Several commercial-scale cellulosic ethanol biorefineries are also currently operational in the US. However, the biofuels produced by the fermentation process have low combustion energy and have high purification costs, which prevent the adoption of the use of ethanol as an economical fuel.

Other processes include hydrothermal processing. This process uses high pressure and moderate temperature rotating machinery to trigger the chemical decomposition of biomass or wet waste materials, which eventually produces an oil that may be further upgraded catalytically to biofuels.

Leave a Comment